Green hydrogen in Spain has gone from being a promise to becoming a tangible reality within the country’s energy transition and decarbonisation strategy—slowly but surely moving beyond the PowerPoint stage. The business opportunity, along with European emissions reduction policies, has accelerated the development of hydrogen projects, although perhaps at a slower pace than many would like.

This comes as no surprise. Spain, thanks to its renewable energy potential, strategic location, and energy infrastructure, has positioned itself as one of the key countries in this transformation. With more than 12 GW of electrolysis capacity planned for 2030 (according to the updated PNIEC—Spainsh NECP— in 2024), the country aims not only to meet its internal demand but also to become a major exporter of hydrogen and its derivatives to the rest of Europe.

Companies and public administrations are driving a wide range of projects—from small-scale hydrogen production facilities to large-scale developments targeting sectors such as steelmaking, transport, and the production of synthetic fuels.

In this article from AtlantHy Academy, we’ll explore some of the most notable hydrogen projects in Spain, both those already underway and others still in the development phase.

And while some may be left out of this list, no doubt a new roundup will be needed soon—which, in itself, is great news for the sector.

Operational renewable hydrogen plants in Spain: which ones are up and running?

Projects in Operation

Major green hydrogen projects in Spain:

Iberdrola’s Puertollano Plant

Illustration 1 Iberdrola’s Plant in Puertollano

Located in Puertollano—a city famously known for the ‘three lies’ in its name (it’s not a port, it’s not flat, and it’s nowhere near the sea :D)—it has a long-standing tradition in the chemical and refining industries, making it a strategic hub for industrial activity. It’s no coincidence that the National Hydrogen Centre is based here, which we highly recommend visiting—it’s a great place to learn from everything they’re doing.

In 2023, Puertollano became home to the largest green hydrogen plant for industrial use in Europe, a project led by Iberdrola in partnership with Fertiberia. The facility features a 20 MW electrolysis system, supported by its corresponding storage infrastructure and backed by a 100 MW photovoltaic solar plant located on-site.

What makes this plant particularly noteworthy is not just its scale, but the technical and operational lessons it offers. Iberdrola has faced challenges integrating renewable energy with large-scale hydrogen production, opting for an integrated solution rather than a modular, containerised system. While the latter would have simplified operations, choosing a more complex configuration has allowed the company to gain valuable insights and establish itself as a key player in hydrogen project development across Europe.

The hydrogen produced at this plant has a clearly defined industrial purpose: the production of green fertilisers by Fertiberia. The goal of this project is to replace grey hydrogen with green hydrogen. However, the initiative still has a long way to go, as—at present—the substitution only accounts for a very small fraction of Fertiberia’s total hydrogen consumption.

Green Hysland

Illustration 2. Green Hysland Plant in Mallorca

Inaugurated in 2024 (after several delays…), the Green Hydrogen Plant in Lloseta (Mallorca) is a cornerstone of the European Green Hysland project—an initiative aimed at developing a renewable hydrogen ecosystem in the Balearic Islands. This innovative project was launched through a public-private partnership led by Acciona and Enagás, with support from the Spanish government and the European Union, and was widely promoted in 2021 as a flagship example of hydrogen’s potential in island territories.

The plant uses solar energy as its primary power source and includes a 2.5 MW electrolyser. One of the most interesting aspects of the project is the diversity of its applications:

- A portion of the hydrogen is injected into the island’s natural gas grid as part of a blending strategy to reduce reliance on fossil fuels.

- Another share is allocated to strategic sectors such as hospitality and public transport, including Palma’s bus fleet and industrial backup generators.

- It is also being considered for use at the Port of Palma, with pilot projects underway to power vessels with hydrogen.

What makes Hysland a standout project is its holistic approach—integrating the production, distribution, and use of renewable hydrogen within an island system. Islands pose a unique energy challenge due to their heavy reliance on imported fossil fuels.

However, this very diversity of applications has also added significant complexity to the project. The involvement of multiple stakeholders—from energy companies to local government (politics also played a role here) and the tourism industry—has presented an additional challenge.

Petronor Pilot Project

Illustration 3 Petronor Pilot Project in Bilbao

Located in Muskiz, next to the Petronor refinery, this green hydrogen plant has become a key component of Repsol’s decarbonisation strategy. Announced in 2020, the facility was presented as the first electrolyser in the Basque Country, with an initial capacity of 2.5 MW and plans to expand to 10 MW in the future. The plant began operations in 2024, after overcoming several delays—an experience that, as with many hydrogen projects, has become part of the sector’s learning curve.

The facility is designed to produce renewable hydrogen to supply the Petronor refinery itself, reducing its reliance on grey hydrogen used in industrial processes. In this context, the green hydrogen will be used for the production of synthetic fuels and for mobility applications, in line with Repsol’s commitment to renewable fuels as a complementary pathway to electrification.

Despite being a significant step forward, the 2.5 MW capacity remains negligible compared to the real decarbonisation needs of the refining sector. To put it into perspective, the Petronor refinery currently consumes over 20,000 tonnes of grey hydrogen per year, while the newly inaugurated plant will only be able to produce around 350 tonnes of green hydrogen annually.

This project is not a standalone initiative, but rather part of the Basque Hydrogen Corridor (BH2C), an industrial ecosystem led by Petronor and Repsol in collaboration with more than 80 companies and technology centres. The corridor aims to develop a full-scale hydrogen value chain in the Basque Country, encompassing production, distribution, and end use across strategic sectors such as industry, mobility, and energy generation.

Barcelona TMB Hydrogen Refuelling Station

Illustration 4 TMB Hydrogen Refuelling Station in Barcelona

In a context where hydrogen for transport seems to have taken a back seat—at least for now—Barcelona stepped forward with the launch of Spain’s first commercial hydrogen refuelling station. Developed by Iberdrola in collaboration with Transports Metropolitans de Barcelona (TMB) and the Barcelona City Council, the facility represents a major milestone.

Inaugurated in 2022, the station was designed to supply renewable hydrogen to TMB’s bus fleet, with an initial capacity of 160 kg of hydrogen per day—enough to fuel an initial batch of eight hydrogen buses. However, the project is scalable, and more vehicles have been gradually added in subsequent phases, with the goal of reaching a fleet of over 60 hydrogen buses in the coming years.

The hydrogen is produced on-site at the facility and dispensed at 350 bar—suitable for refuelling the hydrogen buses.

Beyond public transport, the station has also been designed to serve other industrial and commercial fleets operating in the area, paving the way for future expansion of hydrogen use in freight transport and urban logistics.

EMT Hydrogen Refuelling Station

Illustration 5 EMT Hydrogen Refuelling Station in Madrid

If Barcelona did it with TMB, Madrid wasn’t going to be left behind. In 2023, the city took a step forward with the inauguration of its first public hydrogen refuelling station at EMT’s Operations Centre in Entrevías. This project, developed in collaboration with Fotowatio Renewable Ventures (FRV) and Toyota, not only enables the refuelling of EMT’s first hydrogen bus fleet, but also serves as a real-world pilot. The facility launched with 10 hydrogen buses, and while there are plans for expansion, there’s still a long road ahead.

Green Hydrogen Project at the Port of Valencia

Illustration 6 H2PORTS Project in Valencia

The Port of Valencia is one of the busiest freight hubs in the Mediterranean and, in recent years, has also become a benchmark for sustainable transition. In this context, Valencia has committed to renewable hydrogen by implementing a refuelling station to supply port vehicles—such as terminal tractors and reach stackers—under the H2Ports project.

This initiative, led by the Fundación ValenciaPort in collaboration with Baleària, MSC Terminal Valencia, Enagás, the National Hydrogen Centre, and the Port Authority of Valencia, aims to demonstrate the potential of hydrogen in port logistics operations.

The hydrogen refuelling station installed at the port is not only the first of its kind in a port environment in Spain, but also one of the first in Europe with real-world application in cargo handling operations. Its primary purpose is to supply two types of vehicles:

- A hydrogen-powered terminal tractor operated by MSC Terminal Valencia.

- A hydrogen reach stacker used for container handling at the terminal.

Both vehicles run on fuel cells, although the hydrogen used in this project is produced off-site and transported to the refuelling station. This highlights one of the major challenges faced by ports: the limited space and grid capacity required to generate hydrogen on-site.

While the projects mentioned so far are among the most prominent in terms of impact and visibility, they are by no means the only ones. Across Spain, more and more companies and public administrations are committing to renewable hydrogen, giving rise to initiatives which, though smaller in scale, are also paving the way forward. For instance, the hydrogen refuelling station in Zaragoza—driven by the Government of Aragón and Zoilo Ríos—is part of the Ebro Hydrogen Corridor and focused on industrial applications. There’s also the hydrogen plant in Tarragona, promoted by Repsol, which has begun operations with a 2.5 MW electrolyser, along with many other small-scale projects taking shape across the country.

Major Projects Under Development

So far, we’ve discussed the projects that have moved beyond PowerPoint presentations and into reality. But it’s important to remember that Spain has a long list of hydrogen initiatives still under development. While not yet operational, many of these projects have generated significant interest. Some have been repeatedly announced over the years, others have secured financing, and a few remain in the grey area between ambition (or speculation) and true viability.

Among these are large-scale initiatives and key hydrogen transport infrastructure projects.

The big question remains: how many of them will actually become a reality?

Catalina

The Catalina Project, driven by Copenhagen Infrastructure Partners (CIP), stands out as one of the most ambitious renewable hydrogen initiatives in Spain. The goal is to develop a large-scale green hydrogen complex in Aragón, with an initial 500 MW of electrolysis capacity—expandable to 1 GW in future phases.

The key to this project lies in its integration of solar and wind energy in what the developers claim is one of the best locations in Spain. This would enable the large-scale production of green hydrogen, which would then be transported via hydrogen pipeline to the Valencian Community. There, it would be used to decarbonise industry and maritime transport—or, more recently, be connected directly to Enagás’ hydrogen pipeline network, which we’ll explore shortly.

One of the most significant milestones for Catalina so far has been its selection by the European Hydrogen Bank. This recognition provides both strategic and financial support—nearly €250 million—from the EU. Not only does it strengthen the project’s credibility and viability, but it also positions Catalina as a flagship initiative in the rollout of renewable hydrogen in Spain.

While challenges remain—particularly in infrastructure development and securing offtake agreements—Catalina continues to progress, aiming to launch its first phase in 2027. If it manages to stay on track, it could become one of Europe’s leading renewable hydrogen projects.

Andalusian Green Hydrogen Valley

The Andalusian Green Hydrogen Valley, led by Cepsa (now Moeve), is one of the most ambitious projects in Spain and across Europe. With an announced investment of €3 billion or more, this initiative aims to develop two large-scale renewable hydrogen production plants in Palos de la Frontera (Huelva) and San Roque (Cádiz).

Moeve’s objective is clear: to turn Andalusia into a strategic hub for green hydrogen, capable of supplying local industry and exporting hydrogen to Europe via the H2Med corridor and maritime transport. In its first phase, the project envisions 2 GW of electrolysis (phased in through smaller sub-projects), with production destined for synthetic fuels, green ammonia, and industrial decarbonisation.

The Andalusian Green Hydrogen Valley has the backing of both the Andalusian Regional Government and the Spanish Government, along with strategic agreements with companies such as Fertiberia and Yara for the consumption of the hydrogen produced. If all goes according to plan, the first plants are expected to come online in 2026.

EDP and Its Multiple Developments

EDP has been active in the hydrogen sector for some time, and although its projects haven’t always received the most media attention, the company has managed to secure funding through several key calls. Its strategy focuses on repurposing former energy infrastructure and developing hydrogen hubs in strategic industrial areas.

Among its initiatives are projects in Aboño (Asturias), Los Barrios (Cádiz), and Soto de Ribera (Asturias), where the company aims to leverage decommissioned thermal power plants to produce renewable hydrogen.

EDP has successfully obtained both national and European funding across multiple programs, reinforcing its position within the rollout of hydrogen in Spain.

Hydrogen Backbone Network and H2Med

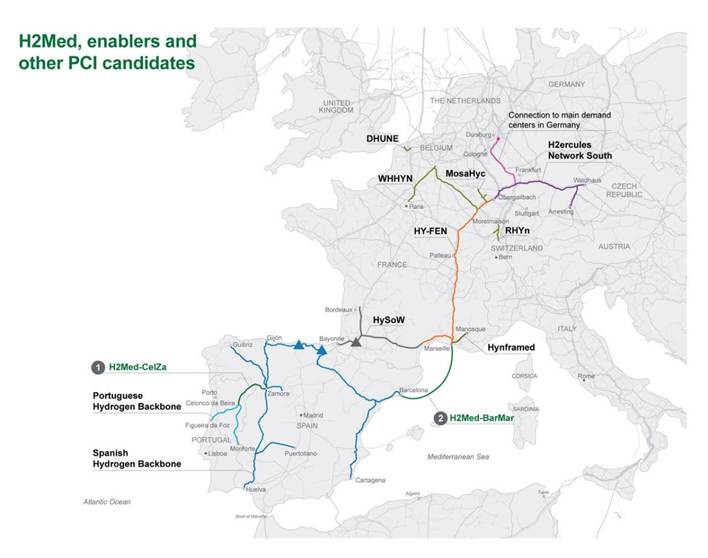

Illustration 7 Enagás Hydrogen Pipeline Network and H2Med

If Spain wants to position itself as a leader in renewable hydrogen, it will need the right infrastructure to transport it — and that’s where H2Med and the future national hydrogen backbone come into play.

Announced in 2022 by Enagás, H2Med will be Europe’s first cross-border hydrogen pipeline, designed to connect the Iberian Peninsula with France via an undersea pipeline between Barcelona and Marseille (BarMar). With an estimated capacity of 2 million tonnes of green hydrogen per year, this corridor would allow Spain to export up to 10% of the renewable hydrogen that Europe plans to consume by 2030. The project also includes a connection with Portugal via the Celorico-Zamora (CelZa) segment, integrating Iberian production into the broader European network. In parallel, Enagás has strengthened its commitment to developing a national hydrogen backbone network that will connect the country’s main hydrogen production and consumption hubs.

Despite the institutional momentum and H2Med’s designation as a Project of Common Interest (PCI) by the EU, the big question remains whether there will be enough hydrogen demand to justify such infrastructure.

If all goes according to plan, the first phase of H2Med is expected to be operational by 2030, marking a milestone in the integration of Spanish hydrogen into the European market. However, as with all megaprojects, it remains to be seen whether the timelines and expectations will match reality—though during Enagás’ Hydrogen Day in January 2025, the company surprised many by announcing that progress was ahead of schedule.

BP and Iberdrola in Castellón

The petrochemical industry is one of the largest consumers of hydrogen, and in Castellón, Iberdrola and BP are well aware of it. That’s why they’ve joined forces to decarbonize BP’s refinery using renewable hydrogen. This project, part of the hydrogen strategy of the Valencian Community, plans to install a 25 MW electrolyzer.

The hydrogen produced will be used to replace part of the grey hydrogen currently used at the refinery. In addition, the plant could supply other industrial and mobility applications, becoming part of a broader ecosystem in the region.

Although the project is already underway and expected to begin operation in 2025, its real impact will depend on scalability. Iberdrola and BP have announced plans to expand the electrolyzer capacity to 150 MW.

One thing is clear: Spain is not short on hydrogen projects—at least on paper. Beyond the ones mentioned, there’s a long list of initiatives that, while not yet fully realized, continue to generate headlines and attract interest.

Among them, we could also include the green hydrogen project in Cartagena, where several companies are exploring the integration of renewable hydrogen into Repsol’s industrial complex, following a model similar to that of Castellón. In Galicia, multiple initiatives have been announced, with Iberdrola, Reganosa, and other players promoting hydrogen hubs in As Pontes and various ports, aiming to supply both industry and maritime transport. And we can’t forget other announced projects that have gained traction, such as HyChemical by Hy5, La Robla by Naturgy, Numantia by Solarig, and Hysencia by DH2… all of which remain at different stages of planning and development.

Conclusions

If there’s one thing certain about the hydrogen sector in Spain, it’s that everything is constantly changing. In just a few months, some of these projects could move forward and become tangible realities, while others might (hopefully not) be left hanging. What seems like a solid plan today may soon require adjustments in financing, industrial partnerships, or technical feasibility.

This article will age quickly, because we’re at a stage where hydrogen is evolving day by day. In the coming months, all eyes will be on the projects that secure funding through key programs like PIONEROS and CADENA DE VALOR, as well as the impact of the European Hydrogen Bank (EHB) and new CEF calls. The rollout of PERTEs will also be critical, as they promise to boost hydrogen deployment across the industry.

The real question now isn’t whether projects will move forward — but rather, which ones actually will, and how the sector will evolve in the years ahead.

REFERENCES

www.iberdrola.es

www.enagas.es

www.fundacion.valenciaport.com

www.petronor.eu