One of the main challenges in the hydrogen economy is its use and transport from producer to consumer, due to the properties of the molecule (European Commission, 2023).

In view of this challenge, and especially at the beginning of the boom in interest in green hydrogen in 2020, the use of an already existing, extensive and efficient gas transport infrastructure such as pipelines for transporting hydrogen gained a large number of supporters.

The idea, consisting in producing hydrogen and injecting it directly into the gas grid, gave rise to a large number of projects, with 72 GW planned in Spain by 2022, the vast majority of which relied on this business model.

However, as the sector matures, renewable hydrogen blending is becoming less and less in vogue.

Why? Does it still make sense? In this AtlantHy Academy article, we will let you know.

Introduction

The interest behind blending is to take advantage of the extensive network of gas pipelines not only to transport hydrogen, but also to be able to turn natural gas consumers into hydrogen consumers. In other words, to get companies or homes that currently burn natural gas in their processes to start introducing hydrogen into their burners or other consuming equipment.

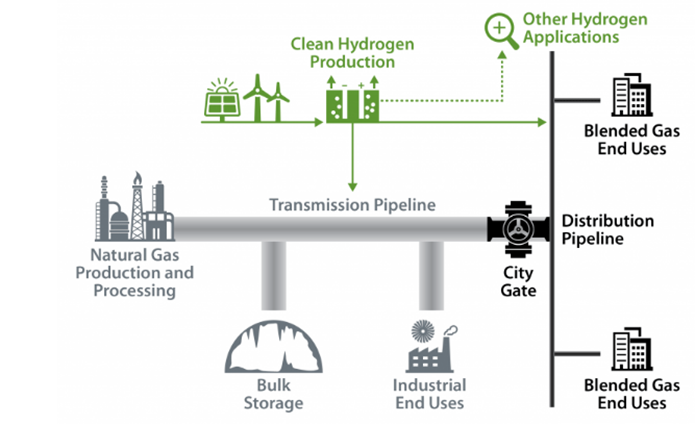

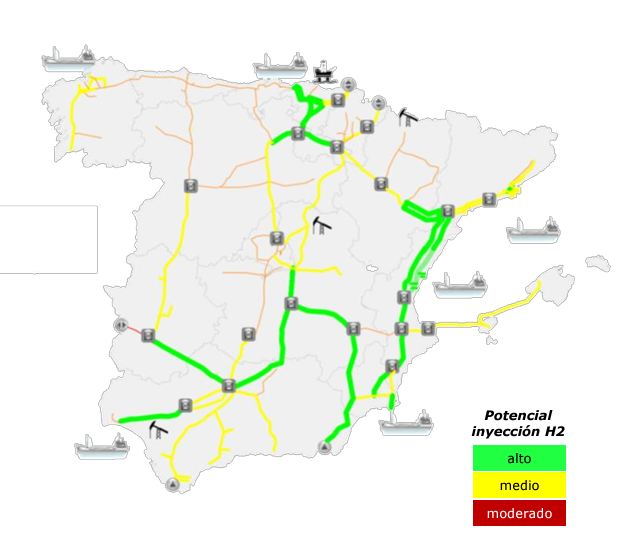

Therefore, hydrogen projects would be located near compressor stations or points identified by Enagás (TSO) or the various distributors (DSOs) that allow the injection of renewable gases. At these points, the hydrogen produced would be combined with natural gas in a mixing chamber to avoid high concentrations in the first few metres of the pipeline (Franco, 2024).

Once the mixture of hydrogen gas and natural gas is created, everything would be considered as natural gas for legal and market purposes. At the same time, the hydrogen generation would have associated guarantees of origin and sustainability certificates (both in a single document) that could be sold to third parties. In this way, the source of income for the owners of the hydrogen plant will be twofold: on the one hand, the sale of the energy contained in the hydrogen and, on the other, the sale of the guarantees of origin to companies seeking to reduce their emissions.

Illustration 1 Basic schematic description of blending (Office of Energy Efficiency and Renewable Energy, n.d.).

At this point we can already highlight one issue, namely that Power-to-Gas (PtG) technology (where hydrogen or methane is generated through electricity) will for the first time make it possible to link the electricity and gas sectors in a bidirectional way, i.e. gas can be generated via PtG and electricity can be produced by burning this gas in combined cycles or engines. This gives energy systems great independence and flexibility, although the costs are not trivial.

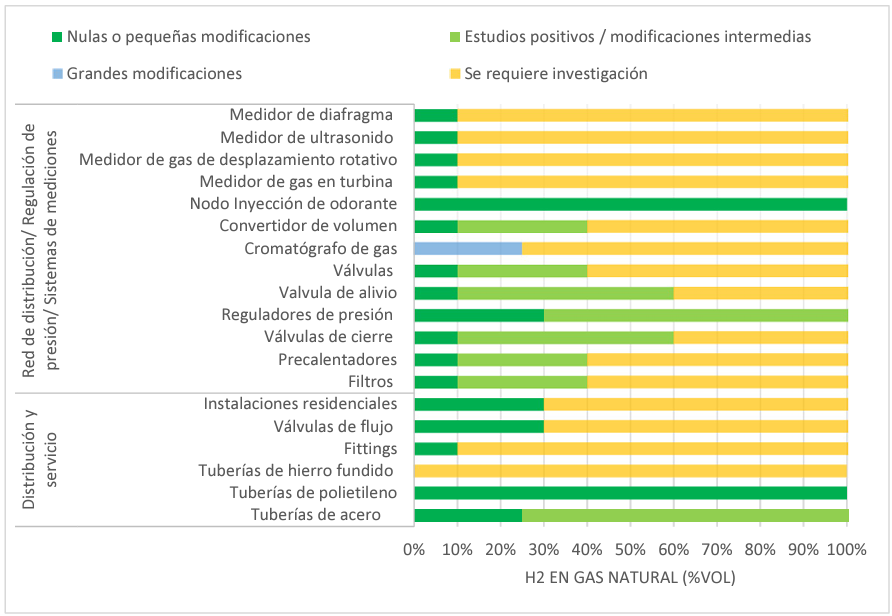

When analysing the technical feasibility of blending, it is important to note that expectations here clash head-on with reality. While what we have heard until recently from the main gas associations or companies involved is that the percentage of hydrogen blending in the gas network could be as high as 20 % by volume without major complications, the reality is that the use of natural gas pipelines to transport hydrogen has technical limitations.

These limitations are not so much related to the tubes themselves, but to the elements associated with the network, especially the end consumer.

While it is true that network elements could accept higher concentrations of H2 by volume, it is the end-users who are penalised the most, as most equipment, such as gas cookers, household heaters or many industrial boilers and ovens, are not prepared to handle more than 5% hydrogen by volume. Even in some cases, such as vehicles running on natural gas, the maximum allowable percentage is around 2 % hydrogen.

For the last 4 years, developers lived in this legal limbo, in which, apart from speculation, there was no certainty as to what would and would not be allowed. Until now, companies and institutions were guided by what was indicated in the Detail Protocol PD-01 ‘Measurement, Quality and Odourisation of Gas’ of the technical management standards of the gas system, where quality specifications are indicated for the quality of gas from non-conventional sources introduced into the gas system, where it is indicated that 5% molar hydrogen can be injected. However, this protocol contemplates hydrogen and gases from non-conventional sources, such as biogas (gas obtained from biomass or other types of gas produced by microbial digestion processes), and therefore does not apply to the case of hydrogen production itself as a source of energy.

However, with the approval of the ‘Hydrogen and decarbonised gas market’ in 2024, the European Union has made it very clear that natural gas containing a maximum of 2 % hydrogen may be transported in all international connections. This, in the absence of separation mechanisms for such low concentrations, means that in practice no more than this percentage is allowed at national level.

To provide context for that 2% hydrogen content within the permitted hydrogen/gas blend, we believe it is pertinent to indicate how many megawatts of electrolysis capacity that percentage represents.

Using the total natural gas demand for December 2023 provided by Enagás—325.4 TWh—to calculate the natural gas and hydrogen flow rates, and assuming an efficiency of 55 MWh/t H₂ and 5,000 hours of operation, we can deduce that this corresponds to approximately 750 MW.

Likewise, this 2% limit is set for the entire network, meaning it restricts the percentage that can be injected both upstream and downstream of the injection point, which has a significant impact on the deployment of hydrogen within the grid. In other words, it could lead to a situation where large hydrogen production plants for blending are installed at the main gas entry points into the country, thereby saturating the pipelines and preventing injection at other locations across the national network.

In this way, it can be concluded that blending is indeed technically feasible, with high admissible percentages in the main elements of the gas network, although with limited tolerance among end consumers. Even so, we must not underestimate the business opportunity represented by 750 MW of electrolysis. So then, does injecting a hydrogen molecule into the gas grid have a future?

What no one tells you about hydrogen blending

Let us now analyse the real interest that might lie behind hydrogen blending, from both a business and sustainability perspective. As you may have noticed, we have consistently referred to the percentage in volumetric or molar terms, making a point of highlighting these distinctions. Why is that? Well, because the energy density of hydrogen is very different from that of methane—in other words, injecting 2% hydrogen by volume is not equivalent to injecting 2% methane by volume.

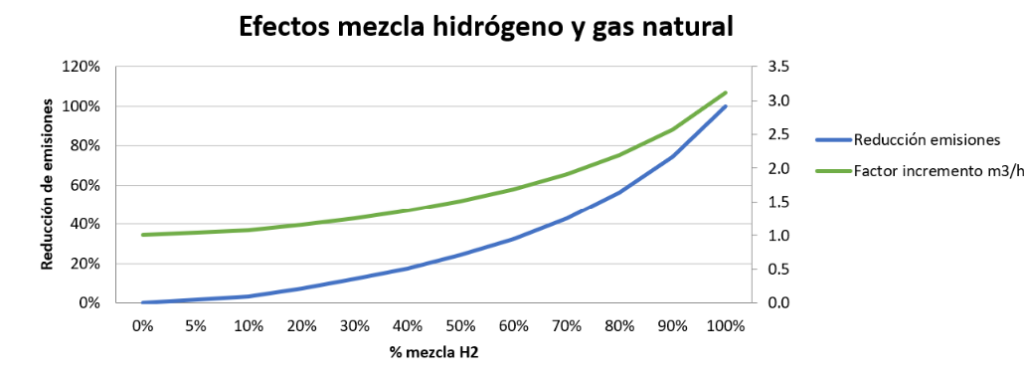

This has a significant impact when conducting studies to assess the value of blending, since the underlying premise must always be to maintain the same calorific value delivered to the customer or end user. How is this achieved in the case of a gas mixture (hydrogen/methane) whose calorific value decreases as more hydrogen is introduced? Quite simply, by increasing the flow rate of the delivered mixture. For instance, as shown in the graph, with a 40% blending ratio, we would need to supply 1.5 times more of the mixture, while only achieving a 20% reduction in emissions.

We also wish to highlight this last point: the reduction in emissions is exponential, with significant benefits only being achieved when the blending percentage exceeds 50–60%—something that is far from becoming a reality. This is simply due to the previously mentioned fact that the calorific value must always remain constant, which in turn requires an increased flow rate and therefore also more natural gas.

We must not overlook the fact that for a 100% hydrogen blend, the gas flow reaching the end user would be three times greater than that of natural gas. This also reveals that equipment compatibility is not only a matter of materials, but also of the flow rates and volumes that must be handled.

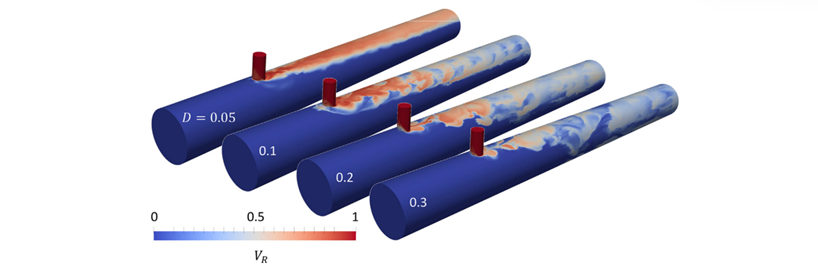

As you may have noticed, there are several factors to consider. There are even other studies dedicated to the behaviour of the gas within the pipeline under specific climate conditions, or to the movement of the fluid inside the pipe depending on its shape and diameter, as shown in the image:

Illustration 4 An angled view is shown of hydrogen flow injected into a main methane line for dilution factors D = 0.0, 0.1, 0.2, and 0.3 with a T-shaped pipe. VR refers to the molar fraction or volumetric fraction of hydrogen in the pipeline (I. Eames, 2022).

Moving away from the technical aspects, it is worth delving into the market side. While we have already emphasised that revenues come from both the sale of energy and the sale of guarantees of origin, it is now time to look at the numbers.

The sale of energy is analysed in a very straightforward way: it is a direct comparison with gas prices. If, at present, gas is trading at around €40/MWh, that would be the revenue received for our hydrogen. Translated into €/kg, this equates to approximately €1.6/kg H₂.

Are we able to produce hydrogen at that cost? The answer is no. Therefore, let us now examine whether the second source of income—namely, the commercialisation of guarantees of origin (GoOs)—can make our renewable hydrogen project economically viable.

GoOs have a value that is difficult to pinpoint. While it is true that part of their worth is objective and quantifiable—namely, the emissions reductions they represent—there is another aspect that is more subjective and company-specific: the value that each business places on decarbonisation. In many cases, the purchase of GoOs is driven by decarbonisation obligations; in others, it stems from social perception… something that is difficult to assign a clear monetary value to.

Therefore, let us begin with an analysis of the emissions reduction associated with the use of renewable hydrogen. In this case, we will compare it to natural gas, which, according to MITECO, has an emission factor of 0.18 tCO₂/MWh. Considering a CO₂ ETS (Emissions Trading System) cost of €100/tCO₂, it is easy to see that for every megawatt-hour of natural gas consumed, we are effectively paying €18 to Europe for the associated emissions.

We now have a final, objective and quantifiable value of €40 + €18 = €58/MWh for hydrogen injected into the gas grid to achieve an objective economic return. This is equivalent to a production cost of €2.3/kg H₂.

You might be thinking… hang on, but guarantees of origin for biomethane are being traded at prices ranging between €60 and €100/MWh!

Well, you’re right—nowadays, these guarantees do indeed hold such value, which makes this type of plant economically viable. We could take this as a given and consider revenues of €100/MWh for hydrogen. When added to the €40/MWh from energy sales, this gives us an equivalent of €5.6/kg H₂—something a bit more appealing. But… do you really believe it? Does it seem reasonable to you?

We must not forget that this is all subject to the law of supply and demand. The number of hydrogen production plants is expected to grow exponentially towards the end of the decade—and so will the availability of guarantees of origin, especially once the hydrogen pipeline arrives.

On the other hand, the value of GoOs lies in the decarbonisation they can offer. Yes, renewable hydrogen does have 0 gCO₂/kWh… but biomethane has negative emissions! So, we’re really comparing apples and oranges here.

Conclusions

Blending is an option to create a market of up to 750 MW of electrolysis today in a country like Spain. It was an option that might have been more attractive in the early stages of deployment (in the promising early 2020s) than it is now, when other projects are emerging that offer greater real benefits for the decarbonisation of our economy.

The approval of the ‘Hydrogen and Gas Decarbonisation Package’ limits hydrogen blending to a maximum of 2% at international interconnections across Europe. This effectively forces the same limit within national borders, as there are currently no economically viable technologies for separating the gases.

Blending generates two sources of income: the sale of energy and the sale of GoOs. Both have an objective component, although the value of GoOs will ultimately depend on how much value the customer places on them.

We recommend listening to Episode 63 of our podcast: Hydrogen Transport and the Hydrogen Backbone Network with Jesús Gil (Enagás) to better understand the purpose of blending.

At AtlantHy, we help companies assess the viability of their projects from a strategic, technical and economic perspective. Don’t hesitate to get in touch—let’s make the best decisions together!

If you enjoyed this article, stay tuned to keep learning from future posts… Follow us on AtlantHy Academy!

Don’t hesitate to contact us to develop your project!

References

ENAGÁS. (2023). PROTOCOLOS DE DETALLE DE LAS NORMAS DE GESTIÓN TÉCNICA DEL SISTEMA GASISTA .

European Commission. (2023). Hydrogen and decarbonised gas market package. Retrieved from Markets and consumers: https://energy.ec.europa.eu/topics/markets-and-consumers/market-legislation/hydrogen-and-decarbonised-gas-market-package_en

Franco, B. A. (2024). Módulo transversal: SO-1 Power-to-Power y Power-to-gas. Escuela de Organización Industrial, 1-24.

Gondal, I. (2016). Hydrogen transportation by pipelines. En Compendium of Hydrogen Energy. Woodhead Publishing Series in Energy.

I. Eames, M. A. (2022). Injection of gaseous hydrogen into a natural gas pipeline. International Journal of Hydrogen Energy , 25745-25754.

IEA. (2019). The Future of Hydrogen. Retrieved from IEA: https://www.iea.org/reports/the-future-of-hydrogen

IKOKU. (1992). Natural Gas Production Engineering. Florida: Jhon Wiley & Sons, Inc.

Kevin Topolski, E. P.-M. (2022). Hydrogen Blending into Natural Gas Pipeline Infrastructure: Review of the State of Technology. NREL, 1-70.

Office of Energy Efficiency and Renewable Energy . (n.d.). HyBlend: Opportunities for Hydrogen Blending in Natural Gas Pipelines. Retrieved from Office of Energy Efficiency and Renewable Energy : https://www.energy.gov/eere/fuelcells/hyblend-opportunities-hydrogen-blending-natural-gas-pipelines