A place to store hydrogen? An energy reserve for europe?

Nothing of the sort. The European Hydrogen Bank (EHB) is not a storage facility or an energy reserve to ensure Europe’s energy sovereignty. Instead, it is a tool designed to boost the development of the hydrogen sector.

How? This article from AtlantHy Academy explains.

Hydrogen Auction?

The European Hydrogen Bank (EHB), announced by President Von der Leyen in her 2022 State of the European Union address, is an initiative to support the EU’s domestic production and importation of renewable hydrogen. Its objective is to unlock private investment in the EU and third countries by tackling investment challenges, bridging the financing gap, and connecting the future supply of renewable hydrogen with consumers. The initiative is funded directly from the Innovation Fund, which itself is primarily financed by carbon emissions payments a revenue stream expected to grow in the coming years.

However, this mechanism works slightly differently from the traditional sector approach of providing direct investment subsidies (CAPEX). The EHB provides direct funding for each unit of hydrogen produced in €/kgH2, with this remuneration granted for a period of 10 years to the most competitive projects, as we’ll see below.

Yes, although it might seem unusual, auctions that incentivize projects by offering a fixed price per kilogram of hydrogen produced similar to a feed-in tariff represent a strong alternative to traditional subsidies that cover initial capital expenditure (CAPEX). This allows for project evaluation based on real competitiveness rather than upfront investment or installed power metrics.

This alternative, which subsidizes production (i.e., per kg of hydrogen produced) to bridge the gap between supply and demand, not only promotes economic efficiency and technological development but also enables cost-effective support by reducing risks for developers. Moreover, the EHB seeks to foster price awareness and transparency, as discussed below.

Image 1. Objectives of the 2023 Renewable Hydrogen Pilot Auction. (Europa.eu, 2024)

The first pilot auction for renewable hydrogen production, which closed in February 2024, was a resounding success. It not only enabled profitable support by reducing risks for developers but also helped build price transparency and establish a new market with relatively low economic management.

2023 Pilot Auction

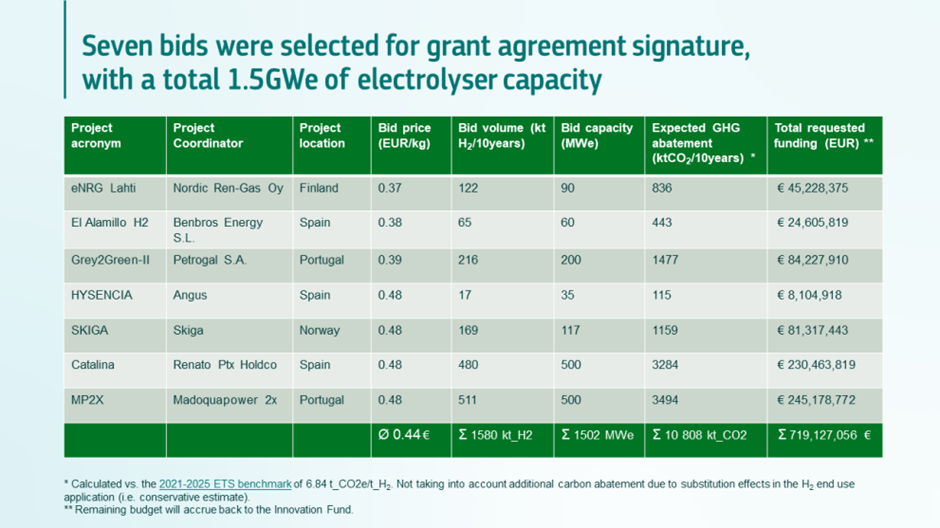

Launched in November 2023 and closed in February 2024, the first auction for renewable hydrogen production attracted 132 bids from projects across 17 European countries. Although 13 projects did not meet eligibility criteria, 7 were selected to receive €720 million from the Innovation Fund (INNOVFUND), marking the auction as a success. These selected projects are expected to deliver a total electrolysis capacity of 1.5 GW and produce 1.58 Mt of RFNBO hydrogen over 10 years (158 kt/year). Bid prices ranged from €0.37 to €4.5/kgH2.

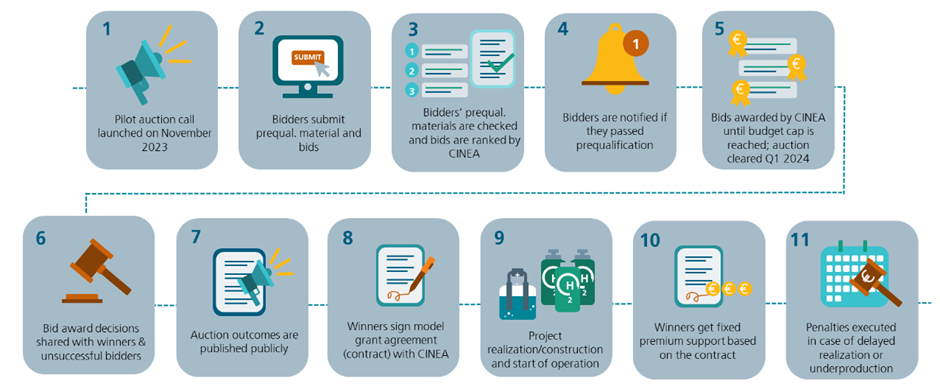

Following the 2023 guidelines, ad pending possible changes, the process includes:

- Call for applications: Bidders submit proposals, reviewed and ranked by CINEA (European Climate, Infrastructure, and Environment Executive Agency).

- Notification of prequalification status.

- Awarding of bids: CINEA allocates funds based on competitiveness until the budget is exhausted and then publishes the results.

- Grant agreement and implementation: Winners sign contracts and begin implementation. They receive a set premium per the contract, with penalties applied for non-compliance.

Image 2. Graphic description of the 2023 Innovation Fund auction process (Europa.eu, 2024)

Visual Analysis of the Auction

The image details the seven selected projects. For example, Spain’s Catalina and Portugal’s MP2X, each with 500 MWe capacity, reflect Europe’s ambition for renewable hydrogen. Both projects are run by CIP, which strategically aimed to maximize funding €250 million per project ensuring a higher aid percentage and leveraging future cost reductions over a five-year timeline.

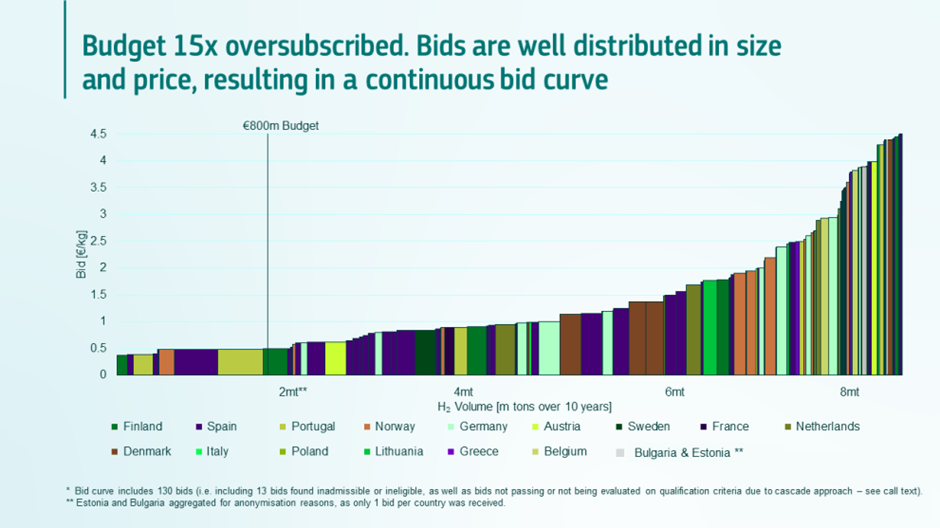

A subsequent image shows how the €800 million budget was exceeded by offers, illustrating high competition and interest in renewable hydrogen production (Europe, 2024).

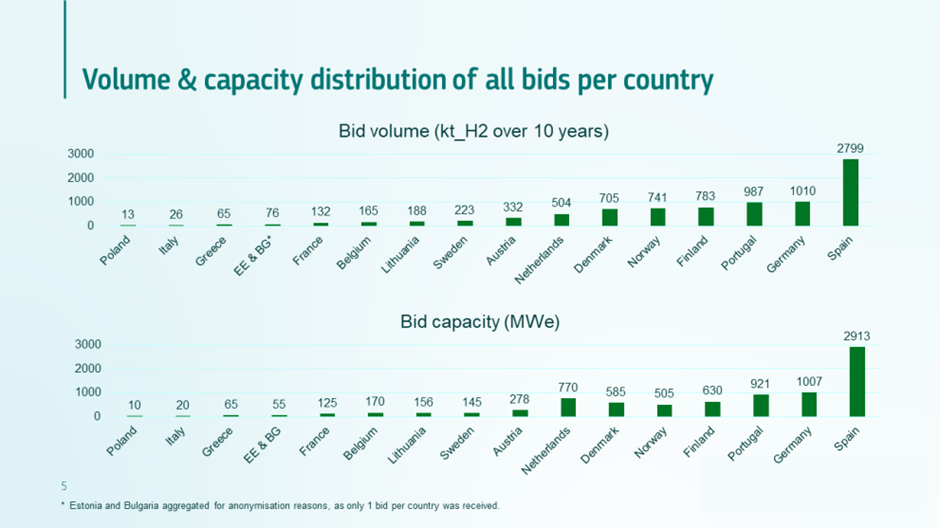

The final image clearly illustrates the volume and capacity distribution by country, with Spain leading in capacity (2913 MWe) and volume (2799 kt H2 over 10 years), followed by Germany and Portugal.

Second auction in 2024

A draft of the terms for a second EHB auction estimates production costs at €3.5–4.5/kg. The subsidy covers the cost gap between production and market prices of RFNBOs (Renewable Fuels of Non-Biological Origin), making the operation competitive and profitable.

This round includes a new maritime funding basket with special terms due to new EU Emissions Trading System rules affecting maritime transport. Eligible projects must show at least 60% of their hydrogen is allocated to maritime off-takers.

The budget is set at €1.2 billion, but final terms are pending. The auction is expected in autumn 2024.

Applicants must submit a Memorandum of Understanding (MoU), Letters of Intent (LoI), or similar documents signed by maritime sector off-takers, along with a declaration confirming their sector involvement.

Additional required documents include a Financial Information File (FIF) detailing bid price (€/kg of RFNBO), average annual production, and electrolyzer capacity. Hydrogen production must begin within three years of signing the grant agreement, unlike the first auction.

The auction will prioritize the maritime basket, with any leftover funds redirected to the general budget and vice versa. Remaining funds may carry over to the next call. A reserve list will also be created for initially unsuccessful projects, which may receive funding under a new “flexibility rule” allowing a 20% budget increase.

Conclusions on the European Hydrogen Bank

The 2023 auction has set a successful precedent for future green hydrogen initiatives, proving that efficient economic models can drive innovation and sustainability. Expectations are high for the 2024 auction, which aims to further advance renewable hydrogen production in Europe. We await the final call publication to align proposals accordingly.

We recommend Episodie 72 of our podcast: Public Funding with Natalia Saiz and Laura Delgado (Deloitte) for more insights.

At AtlantHy, we’re highly successful in securing funding for renewable fuel projects, with a success rate above 80%.

Contact us to launch your project with the support of the European Hydrogen Bank!

If you enjoyed this article, stay tuned for Part 2, where we’ll analyze the terms of the second auction… Follow us on AtlantHy Academy!

We’re standing by!

References

A Valera-Medinaa, H. X.-J. (2018). Ammonia for power. Progress in Energy and Combustion Science , 63-102.

Abdullah Emre Yüzbasıoglu, C. A. (2022). The current situation in the use of ammonia as a sustainable energy source and its industrial potential. Current Research in Green and Sustainable Chemistry, 5.

Andrey Myagkiy, I. M. (2020). Space and time distribution of subsurface H2 concentration n so-called “fairy circles”: Insight from a conceptual 2-D transport model. BSGF-Earth Sciences Bulletin , 1-13.

EU plans to make significant rule changes for the second European Hydrogen Bank subsidy auction. (29 de Abril de 2024). Obtenido de Hydrogeninsight : https://www.hydrogeninsight.com/policy/eu-plans-to-make-significant-rule-changes-for-the-second-european-hydrogen-bank-subsidy-auction/2-1-1634831?zephr_sso_ott=l54OJM

Europa.eu. (April de 2024). Competitive bidding. A new tool for funding innovative low-carbon technologies under the Innovation Fund. Obtenido de Climate Action: https://climate.ec.europa.eu/eu-action/eu-funding-climate-action/innovation-fund/competitive-bidding_en

Europe, C. (2024). Obtenido de https://climate.ec.europa.eu/eu-action/eu-funding-climate-action/innovation-fund/competitive-bidding_en

IEA . (2021). IEA 50. Obtenido de Ammonia Technology Roadmap: https://www.iea.org/reports/ammonia-technology-roadmap

IRENA . (2022). GLOBAL HYDROGEN TRADE TO MEET THE 1.5ºC CLIMATE GOAL: Part I. Abu Dhabi. .

IRENA. (2022). Innovation Outlook Renewable Ammonia. Abu Dhabi.

Jiayi Liu, Q. L. (2023). Genesis and energy significance of natural hydrogen . Unconventional Resources , 176-182.

Lu Wang, Z. J. (2023). The Origin and Occurrence of Natural Hydrogen. MDPI, 19.

Matthew J. Palys, H. W. (9 de Diciembre de 2020). Renewable ammonia for sustainable energy and agriculture: Vision and systems engineering opportunities. Department of Chemical Engineering and Materials Science, págs. 1-5.

Matz, M. (Marzo de 2022). The Breakthrough Potential of Green Ammonia. Business & Technology Surveillance, págs. 1-11.

Opeyemi A. Ojelade, S. F.-J. (2023). Green ammonia production technologies: A review of practical progress . Journal of Environmental Management , 17.

Rubén Blay-Roger, W. B. (2024). Natural hydrogen in the energy transition: Fundamentals, promise, and enigmas. Renewable and Sustainable Energy Reviews , 9.

Stones, J. (30 de Abril de 2024). ICIS EXPLAINS: EU Hydrogen Bank pilot auction results . Obtenido de ICIS: Independent Commodity Intelligence Services : https://www.icis.com/explore/resources/news/2024/04/30/10994621/icis-explains-eu-hydrogen-bank-pilot-auction-results/