You already know our position regarding the hydrogen backbone network. It’s an all-or-nothing situation for hydrogen in Spain and much of the world. In this analysis, the first of our newsletter, we’ll explore why the development of hydrogen in Spain will require this infrastructure at the expense of electricity grid.

To illustrate this, we’re going to use a very simple example in which, for a given location, we calculate the levelised cost of hydrogen (LCOH) of a 100 MW plant operating 60% of the time through solar and wind PPAs priced at €35 and €55/MWh respectively. We’ll refer to this LCOH as the “base LCOH”.

Then, we’ll begin to add all the costs associated with using the electricity grid to deliver the energy obtained via the PPAs to the plant. These include charges such as grid tolls, electricity tax, balancing services and technical constraints, losses, and local taxes. To be generous, we’ll estimate them at €20/MWh, although we’re well aware they’re already above that this year. We’ll refer to the effect of these costs as the “grid surcharge”.

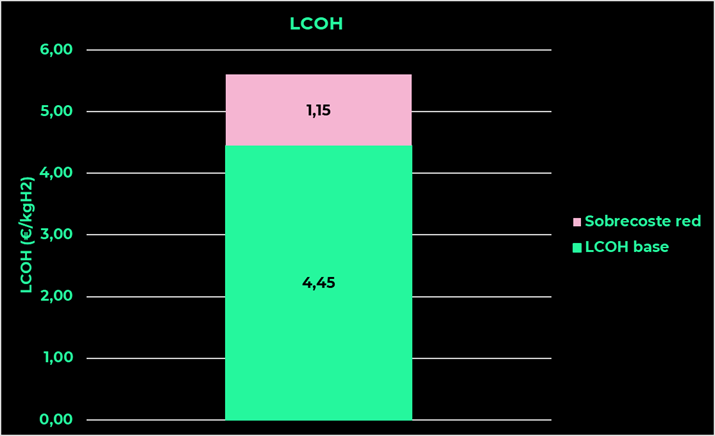

Graph 1. LCOH of the project under study, calculated with the digHy software.

It can be observed that the base LCOH of €4.45/kgH₂ increases by €1.15/kgH₂ (25%) solely due to grid-associated costs. This surcharge is static—that is, if our production cost were €3/kgH₂, the grid overcost would remain exactly the same, representing 40% of the final LCOH.

Electric grid overcosts imply an increase of €1.15/kgH₂ in our LCOH. But how much lost revenue does this actually mean?

If we take the PNIEC targets as a reference—with 12 GW deployed by 2030 (something that by now we should already consider unachievable, but which we’ll use here for illustrative purposes)—Spain should be producing approximately 1.2 million tonnes of hydrogen. This hydrogen, in the absence of a hydrogen pipeline, would largely rely on the power grid to import energy, as seen in most of the projects submitted under the “Hydrogen Valleys” call.

*(We won’t go into the percentage of self-consumption projects or the total GW deployed—that’s a separate issue we’ll leave for future analysis)*

1.2 million tonnes of hydrogen, or 1,200,000,000 kgH₂ per year, each carrying an overcost of €1.15/kgH₂, would result in an annual payment to the electricity system of €1,380,000,000.

With a total estimated investment of €6,000 million for the entire hydrogen pipeline network, the figures speak for themselves: in just four years, the CAPEX of this infrastructure would be recouped. Based on other analyses carried out by AtlantHy, this infrastructure should result in a transport cost of between €0.20–€0.60/kgH₂ depending on the scenario.

*(We’ll leave that analysis for another time too)*

The hydrogen pipeline is the only real option Spain has to achieve the scale we aim for in hydrogen deployment. This brief analysis clearly shows that relying on the electrical grid is not an economically attractive solution—even without delving into critical issues such as:

❌ Investments required to reinforce the power grid to absorb the load demanded by 12 GW of electrolysis capacity.

❌ Timelines and costs associated with the development of electrical infrastructure, which are often borne by the hydrogen project developer.

❌ Lack of transparency regarding grid availability, which leads to delays in project development.

❌ Advantages of the hydrogen network, such as storage and access to the European market—where hydrogen will be less competitive than Iberian production.