On 14 July, the Spanish projects selected by CINEA (European Climate, Infrastructure and Environment Executive Agency) to receive up to €377 million in funding through the European Hydrogen Bank mechanism were officially announced.

Let’s recall that this programme—now in its second call for proposals—had a European budget of €1.2 billion, to which Member States could add additional national funding, using the infrastructure already established by the EU to evaluate and reward projects. In this case, Spain contributed an extra €400 million to the call for national projects, bringing the total available for Spanish initiatives to €1.6 billion. With the publication on 14 July, the allocation of budgets to the selected projects has been completed… or has it?

Let’s take a look:

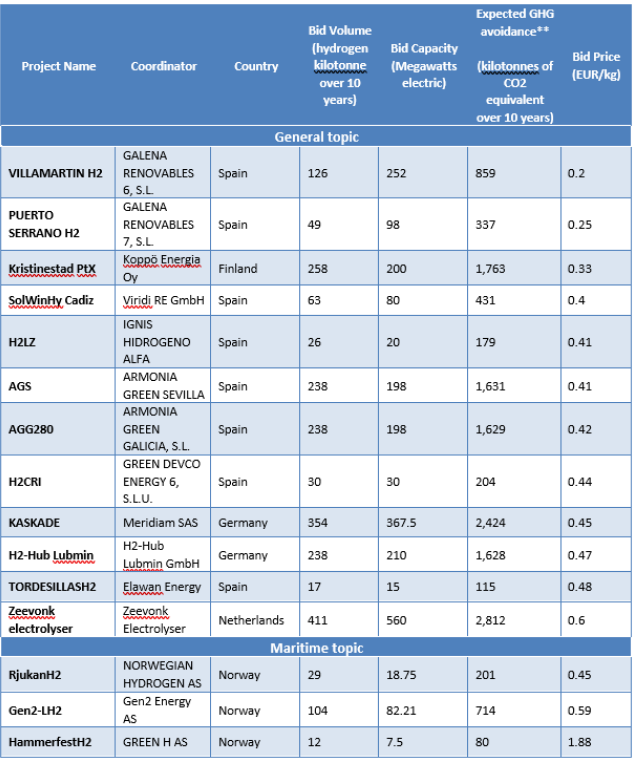

Regarding the main call funded by the EU, the awarded projects and their clearing price (€/kgH2) were:

Illustration 1 Projects awarded in the 2nd Auction of the European Hydrogen Bank with EU funding

As expected, Spain—thanks to its privileged position for producing H₂—has led in terms of awarded projects, although it missed the boat in the maritime basket, where the clearing price reached €1.88/kgH₂, a level of support that does make derivative fuel projects for this sector economically viable.

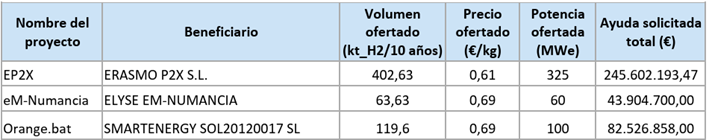

As for the projects awarded under Spanish national funding:

Illustration 2 Projects awarded in the 2nd Auction of the European Hydrogen Bank with Spanish national funding

In this case, it is worth highlighting that these are more mature projects, where the requested subsidies are somewhat more reasonable—bringing the projects closer to profitability, despite still facing numerous challenges.

The following table provides a more detailed breakdown of each of the projects awarded in Spain:

Table 1 Information on projects awarded in Spain under the European Hydrogen Bank

| Project | Promoter | Description | Hydrogen use |

| VILLAMARTIN H2 | Avalon | Green hydrogen production plant using 250 MW alkaline electrolysis in Villamartín (province of Cádiz). It will be powered by a self-consumption photovoltaic solar plant of approximately 365 MWp covering around 695 hectares, and will also incorporate a battery backup system. Estimated annual hydrogen production: approx. 33,000 tonnes. | Aimed at large-scale production to decarbonise hard-to-abate industrial and transport sectors. Specifically, the hydrogen from Villamartín will be channelled towards the Port of Algeciras area to supply maritime transport and conversion into fuels such as green ammonia, as well as for use in the fertiliser, chemical and energy industries. |

| PUERTO SERRANO H2 | Avalon | Green hydrogen project with 100 MW of electrolysis capacity, associated with photovoltaic solar plants totalling ~262 MWp. Although named Puerto Serrano, the electrolysis facility will be located in El Coronil (Seville). | It will form part of the provincial hydrogen network connected via hydrogen pipelines. Its output will be used for the same purposes as Villamartín H₂, contributing to the supply of clean fuel for vessels at the Port of Algeciras and emissions-free feedstock for industries (fertilisers, chemicals, energy refining). |

| SolWinHy Cádiz | Viridi | Pioneering plant for green methanol production through the integration of renewable hydrogen and biogenic CO₂. It will be located in Arcos de la Frontera (Cádiz) and will include an ~80 MW electrolyser, powered by a purpose-built 54 MW wind farm and a ~165 MWp photovoltaic solar plant. Estimated annual production of ~5,500 tonnes of green hydrogen, to be synthesised on-site into around 29,000 t/year of methanol. | All hydrogen produced will be used to synthesise e-methanol (methanol of renewable origin). This resulting fuel will be supplied to an industrial client in Germany, already secured through a preliminary agreement. |

| H2LZ | Ignis | Industrial-scale green hydrogen project with 20 MW of electrolysis in La Zaida (Zaragoza), Aragon. | The hydrogen produced will be entirely allocated to the Evonik Peroxide Spain chemical plant in La Zaida, where hydrogen peroxide (H₂O₂) and its derivatives are manufactured. H2LZ will supply renewable feedstock for hydrogen peroxide production, reducing the plant’s CO₂ emissions by ~28,000 tonnes annually. |

| AGS | Ignis | 198 MW plant in Seville for ammonia production. | The hydrogen will feed a high-capacity green ammonia plant. The resulting NH₃ will primarily be used for fertilisers and other industrial applications, as well as for the export of green energy. |

| AGG280 | Ignis | 198 MW plant in Arteixo (A Coruña) for ammonia production. | The hydrogen will feed a high-capacity green ammonia plant, and the resulting NH₃ will be primarily used for fertilisers and other industrial applications, as well as for the export of green energy. |

| H2CRI | Saeta Yield | 30 MW electrolyser complemented by existing renewable energy sources in the area. Not many further details are available about the project. | – |

| TORDESILLAS H2 | Elawan Energy | Proposed green hydrogen plant in Tordesillas (Valladolid), Castilla y León. This is a relatively smaller-scale project, with an electrolyser estimated at around 15 MW (not officially confirmed) to produce approximately 1,700 tonnes of H₂ per year. | – |

| EP2X | Erasmo P2X | Power-to-X platform of 325 MW that produces H₂ for synthesising e-fuels (methanol and ammonia), capturing CO₂ from nearby industries in Saceruela (Ciudad Real). | Given its large production scale, EP2X will serve as a hydrogen hub in central Spain. A significant portion of the H₂ will be used for the synthesis of e-fuels, with a notable agreement in place to develop an e-methanol plant in Puertollano in partnership with Magnon (Ence group). This plan aims to capture approximately 380,000 tonnes per year of biogenic CO₂ from Magnon’s biomass plant in Puertollano and combine it with hydrogen from Saceruela to generate up to 200,000 tonnes of e-methanol annually, intended for aviation, maritime transport and the chemical industry. |

| eM-Numancia | Elyse | 60 MW plant in Garray (Soria) that produces H₂ and combines it with CO₂ to generate e-methanol. | This e-methanol is primarily intended for the maritime transport sector, serving as an alternative fuel for merchant vessels, and possibly for air transport (it could be used as a base for SAF, sustainable aviation fuels). |

| Orange.bat | Smartenergy | 100 MW project that integrates long-duration batteries with electrolysers to make green H₂ production more flexible according to grid demand. | All the hydrogen generated by Orange.bat will be used to replace natural gas in the kilns and thermal processes of ceramic factories in the province of Castellón. |

As we have seen, there are all types of projects—from small- and large-scale hydrogen production to production aimed at the synthesis of derivatives such as ammonia and methanol. These initiatives are now included in the final resolution of this second call of the EHB, but… does that mean they are as attractive as they might seem at this stage?

While the European Hydrogen Bank is the first mechanism that can truly make a large-scale hydrogen project viable, all that glitters is not gold. These are grants provided at the time of production—in other words, the funding is received gradually as the hydrogen is produced over the aforementioned 10 years. And this is where a less visible phenomenon can emerge: the loss of money’s value over time. Receiving 1 euro today is not the same as receiving it in 10 years. This is clearly illustrated using Net Present Value (NPV), which allows us to bring the value of a series of future cash flows into today’s terms, using a rate that reflects the return expected by an investor.

If we apply the net present value calculation here—taking into account the time value of money and assuming a discount rate of 8%—we can see how the figures shown in the aid result tables decrease significantly:

Table 2 Impact of the time value of money on EHB aid

| Project | €/kgH2 (EHB) | €/kgH2 with net present value | Total aid (M€) | Aid with net present value (M€) |

| VILLAMARTIN H2 | 0.20 | 0.13 | 25.20 | 16.91 |

| PUERTO SERRANO H2 | 0.25 | 0.17 | 12.25 | 8.22 |

| SolWinHy Cádiz | 0.40 | 0.27 | 25.20 | 16.91 |

| H2LZ | 0.41 | 0.28 | 10.66 | 7.15 |

| AGS | 0.41 | 0.28 | 97.58 | 65.48 |

| AGG280 | 0.42 | 0.28 | 99.96 | 67.07 |

| H2CRI | 0.44 | 0.30 | 13.20 | 8.86 |

| TORDESILLAS H2 | 0.48 | 0.32 | 8.16 | 5.48 |

| EP2X | 0.61 | 0.41 | 245.60 | 164.80 |

| eM-Numancia | 0.69 | 0.46 | 43.90 | 29.46 |

| Orange.bat | 0.69 | 0.46 | 82.52 | 55.37 |

We can see here that a large number of the projects are not significantly above the amounts granted, for example, under H2Pioneros, and those grants have not been sufficient to stimulate the development of projects with very similar characteristics. What’s more, they require the entire investment to be made upfront—something that is not always necessary in other schemes, where in some extreme cases it’s even possible to finance nearly the entire project through a combination of debt and grants (though this is not the norm).

As for the larger-scale projects, such as AGS, EP2X or Orange.bat, the grants awarded are still not higher than those received, for instance, in the Hydrogen Valleys (which were also disbursed in year 0), so we will have to wait and see what decisions they take. In some cases, the support even overlaps—as with Ignis, or others like Orange.bat, aimed at replacing natural gas in the ceramic industry, where the price of hydrogen must be extremely low (below €3/kgH₂), a threshold that is not achieved with the aid granted in this call.

Are you giving up the grants?

In short, we have seen how, among other things, the time value of money distorts the real impact of the aid provided through this programme, making low bids effectively even lower.

Over the past week, a rumour has been circulating in hydrogen circles that several withdrawals have taken place within this programme, with CINEA reportedly contacting projects that had requested aid above €1/kgH₂.

This is news we at AtlantHy certainly welcome, as these are the kinds of projects that truly have a higher chance of success. We hope this brief analysis has helped shed light on the “trap” hidden behind a 10-year grant structure, further compounded by a degree of “craftiness” from certain companies—something that exposes the need for the sector to demonstrate maturity and robustness.

Our top 3?

Many of you have often phoned us to ask which projects we believe have the highest chances of success in this type of call. Here, we’ll save you the effort and give you our honest take. If we had to bet on three, they would be:

- EP2X (Erasmo P2X)

- SolWinHy Cádiz (Viridi)

- H2LZ (Ignis)