From AtlantHy ,we’ve had the opportunity to participate in several Due Diligence processes aimed at investing in or acquiring hydrogen, methanol, or renewable ammonia projects. Essentially, our role is to ensure that, from a technical, legal, and commercial standpoint, the projects meet the required standards. Unfortunately, projects are not always presented to investors with the necessary level of quality and that’s why we’re here today, to help make your projects bankable.

In this article from AtlantHy Academy we want to share some of the lessons we’ve learned through these experiences.

What You Should and Shouldn’t Do if You Want Your Project to Be Bankable

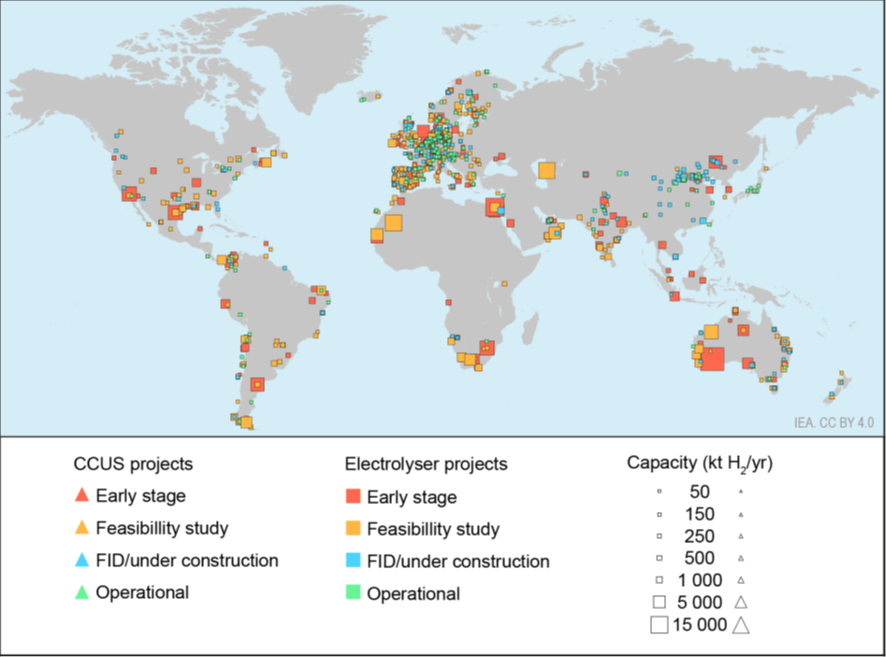

We are sure that all of you have felt how this 2024 has come loaded with negativity in the sector and, well, the truth is that the doomsayers are partly right. If the International Energy Agency highlighted in its report “Global Hydrogen Review 2023” (1) that only 4% of the projects announced in previous years had reached the Final Investment Decision (FID), all of us who are in the sector observe with a bit of envy that small percentage. In Spain, not even the projects that have already received grants are managing to materialize them, and that’s because from the PPT to the financial close of a project, there is a long road that can be truly arduous.

Illustration 1: Announced Projects and Their Development Stages (1)

First of all, for those less familiar with this process, we’re going to explain what a Due Diligence (DD) is and why hydrogen and its derivatives have started to appear in several of them over the past year.

When a company develops a project, it is most common for it to advance it with its own resources (time and money) up to a certain pointeither obtaining administrative and environmental permits, the so-called ready-to-build, or simply securing certain subsidies that demonstrate some validity of the work carried out. These are the most lucrative phases of a project this development from scratch (Greenfield) that turns an idea into something more concrete and tangible, something with form and substance where a potential economic return begins to emerge. At this point, whether due to a lack of own capital (it’s time to start spending hundreds of thousands of euros) or because the following steps are no longer as profitable, many companies begin to bring in capital partners (investment funds, banks, or larger players) who can guarantee the successful development of the project by providing financial muscle.

At this stage, the developers (Sponsors) present the project to the investor (Lender) who will have to evaluate it to decide whether they’re interested in participating. This analysis process is usually not done internally, but rather an advisor or Lender Advisor is hired. This is where we step in to carry out these analyses or Due Diligences.

This advisor, who is assumed to be an expert (financial, legal, technical, or all of the above) in the field, is responsible for putting the project to the test, questioning all its hypotheses and looking under every stone, so that if something is hidden, it comes to light and can be resolved.

As you can imagine, this is where a large number of hydrogen projects have run aground in recent years, because not everything can be supported on paper, no matter what is said. A significant part of the hydrogen projects developed in 2020 and 2021, under the golden fever of the Next Generation Funds, have been put up for sale over the past two years, and we’ve had the opportunity to evaluate some of them.

In this article, we want to share with you what we consider to be the most repeated mistakes and successes in the projects we’ve seen—those that have most frightened or attracted Big Money. Thus, we will divide the advice according to the different parts of the Due Diligences in which we participate:

Regulatory Compliance

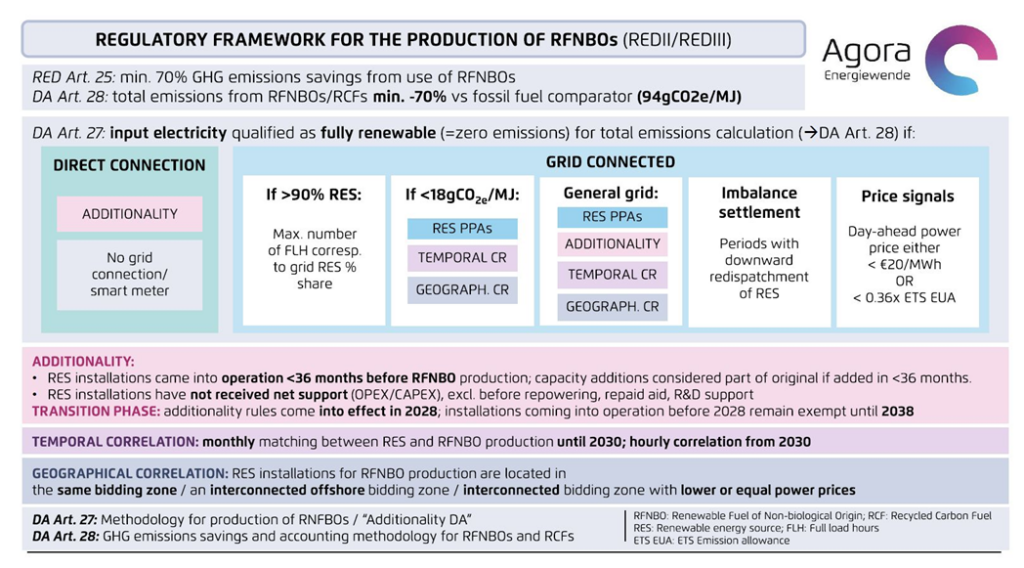

As you know, in recent years, regulation around renewable hydrogen and its derivatives (methanol, ammonia, SAF, etc.) has been in constant flux, with particularly significant changes related to the supply of renewable energy (the well-known hydrogen delegated acts). This has been very cumbersome for all of us who had projects planned since 2020, and the truth is that nobody knew exactly what the regulation would be until it was published in February 2023 (and even today, the Q&A (2) published in March 2024 still show us that we didn’t have it as clear as we thought).

On the other hand, the fact that the regulation has been demanding and changing does not exempt us from complying with it, and projects often reach the investment stages proposing hydrogen production that is not at all renewable. Remember, according to the delegated acts, to produce renewable energy, the three principles must be met: temporal correlation, geographical correlation, and additionality. We could also account for grid energy as renewable, but only to a certain percentage (year n-2).

In addition, we must be able to ensure that the CO₂ reduction in the hydrogen or final fuel is at least 70%, something that starts to get messy as soon as we stray from the provisions of the delegated acts.

Illustration 2: Main Criteria Reflected in the Delegated Acts for the Production of Renewable Hydrogen

It seems unbelievable at this point, but there are a large number of projects being submitted without complying with regulatory requirements. This makes us question whether these are truly issues that the Sponsor is unaware of, or whether they are instead trying to place initiatives that can no longer be redirected due to the loss of economic profitability, in order to move on to other new ones which can completely break the trust needed to carry out these types of transactions.

However, a project that does not comply with the regulation is a project that shows lack of knowledge on the part of the Sponsor, which raises all the alarms and causes Lenders to adopt a much more reluctant attitude. Even so, if the decisions are well justified such as ruling out the production of RFNBOs during certain hours—the projects can still be interesting.

Lesson: Make sure you seek financing for your project with a 100% finalized approach that complies with the regulation.

Very much related to the regulation is the issue of blending. If during 2020 and 2021, all the companies in the sector were busy developing projects to inject into the natural gas grid, starting in 2022 almost all of them began trying to sell them curiously, when it started to become clear that this alternative was not well regarded by regulators or gas transporters.

We have analyzed GWs of such projects, and they all had the same weak points. What is the percentage of blending that would be allowed in the grid? Well, according to the Sponsors, between 5 and 20%. According to reality, and as confirmed this past month with the agreement of the European Parliament, only 2% of the gas content in the gas grid may be hydrogen (3). Furthermore, there is still no procedure for injecting hydrogen into the natural gas grid (currently being drafted by the CNMC), not to mention that in Spain, we have only a few and very specific natural gas entry points, which makes the risk of saturating the gas grid with injected hydrogen at these points extremely high. This is something very hard to accept for a financial entity presented with a blending project in the middle of Castilla y León, leaving aside, of course, the economic figures of this option, which, without a guarantee of origin market + sustainability certificates up and running, cannot be achieved.

Lesson: Make sure you support your theses with public data and not with speculation.

Economic Approach

How are the DEVEX and CAPEX of a hydrogen or derived fuel facility divided? How do energy costs, maintenance, stack replacement, or degradations over the plant’s lifespan impact the project? Have licensor fees been considered as part of the DEVEX? How were contingencies determined in case of cost increases during execution or operation?

We’re not going to deny that this is an area where we’ve seen significant improvement in projects over time. It was not uncommon at first to receive Sponsors with projects in which the total investment cost was exclusively the cost of the electrolyzers (the one found in studies or manufacturer offers). However, time has taught us that, depending on the project size and the technology used, between €400 and €700/kW should be added to obtain the full turnkey cost (generally reflected in the EPC contract).

You must be very meticulous with numerical values, as today we already have reference data from several projects, and any deviation may be closely scrutinized. Again, no Lender will look kindly on major assumptions changing during the Due Diligence, as it is a sign of project immaturity.

Ilustración 3 Conjunto básico stack + balance de stack ofertado por la mayor parte de los fabricantes

We begin this section by talking about DEVEX and CAPEX, perhaps to follow a chronological order throughout the development, but we all know that when we talk about hydrogen production costs, electricity is the one that rules, and I’m sorry to say it so plainly, but here a market prospecting or an estimated offer is not enough. Which parks, at what price, and what electricity supply profile they will be providing us with are requirements to avoid any type of “red flag.” This is not up for debate and, once again, a project that doesn’t have this tied down is an immature project that reflects poorly on its Sponsor.

However, it is a delight to analyze some approaches in which, hour by hour, the photovoltaic, wind, and grid curves are overlaid, where the effects of grid tolls (and even charges) are accounted for based on the feeding hour, and others where the effects of the delegated acts are evaluated with the possible exceptions depending on grid prices (although these remain speculative).

Also speaking of costs, it should be noted that it’s not bad to make some future projections. We all expect to replace stacks in a few years (8–10), or renegotiate a PPA after 10/15 years. Here, the base scenario should not assume that prices will remain as they are today, nor even efficiencies, so it is not necessary to do so, as it may penalize the project unnecessarily.

Finally, do not take for granted that projects will receive public funding.

Lesson: Have your economic package closed. Back up your Excel figures with contracts or binding agreements. Make an effort to show that you understand how a hydrogen plant works in the long term.

Technical Approach

We continue navigating the seas of a hydrogen and derivatives project, and we arrive at the port that we engineers like the most and that, for some reason, Lenders ask about the least: the technical approach. This is where we understand why we are hired, because there are many things that a less experienced view might overlook.

Let’s say it as briefly as it is harshly: a project without water and without electricity from the grid is not a project, at least not one that is financeable. Leaving this to chance is not a good idea, as they are fundamental aspects for a hydrogen plant to be installed. In the case of electricity, a Sponsor would have to make a serious effort to justify a standalone plant (powered only by renewable parks in direct self-consumption mode).

On the other hand, there is the selection of equipment and plant sizing. In this regard, little more can be said than that a Lender needs more than an administrative project to support financing. The main systems must be well defined, with specific offers for the project from the technologists, and everything else related to control, electricity, connections, assembly, etc. must be well covered. Moreover, the FEED or Pre-FEED presented must show a comprehensive understanding of the main points of the plants and… DON’T FORGET SAFETY ANALYSES!

Do you have any idea how much a project can change after a HAZID or a HAZOP? What can enter or no longer fit in a space after changing equipment or their layout?

A hydrogen project that has not gone through its corresponding loop of safety and risk analysis exercises is, again, an immature project subject to many changes that can prevent financial close.

Illustration 4: Safety Studies to Be Carried Out Throughout the Development of a Project (4)

Finally, and as a recommendation, no one wants to make mistakes on their first hydrogen, methanol, or ammonia project. Therefore, choosing top-tier technologists is a point in favor of system reliability and safety. On the other hand, cheaper but more uncertain suppliers, like the Chinese ones, are a source of flags that investors do not like at all, especially after seeing the problems occurring in the first large-scale plants. For example, we do not recommend them for variable load systems.

Lesson: Conduct safety analyses throughout all phases of engineering. Select prestigious suppliers. Ensure access to basic resources.

Contracts

Finally, we reach the phase that Lenders love but engineers dislike (luckily, we have good lawyer friends for these things): contracts.

How is a hydrogen purchase agreement (HPA) defined? Well, mainly with two terms: by available capacity and by delivered product. To this is added a variable (completely subjective), which is the green premium, because yes, not everything sold is renewable hydrogen, and not everything sold has the same amount of associated CO₂. Therefore, another tip here: make sure the sustainability of your hydrogen is well proven before putting it on the market, or you may find yourself tied to a contract you are not able to fulfill (remember that certification to determine if you are an RFNBO is carried out once the plant is in operation), and even more so in this type of environment where we receive new updates on hydrogen classification criteria every day. Also, don’t forget to include in these contracts the decline in hydrogen production over the years (or increased electricity consumption), as well as downtime due to maintenance or stack replacements.

There’s less to say about the more classic EPC and O&M contracts. Here, I simply recommend that the EPC must guarantee a performance for the plant over a few years, and even stay on beyond the Commercial Operation Date (COD). On the other hand, O&M must ensure completion of daily, weekly, and monthly tasks, but also occasional ones, like the aforementioned stack replacement, which may be performed by the O&M company or simply preparing the plant for an external action. Honestly, I don’t think there are big risks that a specialized firm won’t be able to foresee, since these are fairly standard in the industrial world. However, I will say that with such novel projects, where EPC contractors and O&M companies are fighting to gain ground, it is very likely that they will undercut bids and later try to correct them. Faced with this, Lenders’ favorite option is to force contracts to assume any type of deviation, with most contingencies transferred to these agreements.

Lesson: Learn very well the specifics of a hydrogen plant and everything that may deviate from a real EPC and O&M. Be cautious in your model and include contingencies in the contracts. Try to shift responsibilities and ensure that plant operation will not be a problem.

Conclusion

And that’s it for this brief overview of some of the lessons learned during the evaluation of various projects. You only get one chance to make a good impression, and when you’re looking for a partner for the development of an electrolysis, methanol, or ammonia plant, you better come prepared to your meeting!

From AtlantHy, we can conduct Due Diligences or prepare your project so it passes them successfully. Follow us at AtlantHy Academy to keep learning through articles where we help you explore new areas of our sector.

References

(1) Global Hydrogen Review 2023. https://www.iea.org/reports/global-hydrogen-review-2023

(2) Q&A implementation of hydrogen delegated acts https://energy.ec.europa.eu/document/download/21fb4725-7b32-4264-9f36-96cd54cff148_en?filename=2024%2003%2014%20Document%20on%20Certification.pdf

(3) European Parliament legislative resolution of 11 April 2024 on the proposal for a regulation of the European Parliament and of the Council on the internal markets for renewable and natural gases and for hydrogen (recast) (COM(2021)0804 – C9-0470/2021 – 2021/0424(COD)) https://www.europarl.europa.eu/doceo/document/TA-9-2024-0282_EN.html

(4) Guía de seguridad del hidrógeno de Bequinor. https://bequinor.org/general/guia-de-seguridad-del-hidrogeno-de-bequinor/