Developing the renewable hydrogen sector is essential to achieving the climate targets set by the European Union. Reaching this milestone requires the implementation of policies that promote both market growth and technological neutrality. Want to know what public policies are in place for the renewable hydrogen sector?

In this AtlantHy Academy article, we’ll break it down for you.

European Climate Policies and Frameworks

The European Union’s climate initiatives are grounded in the commitments set by COP21, also known as the Paris Agreement, which aims to keep the global average temperature increase well below 2 °C above pre-industrial levels, while pursuing efforts to limit the rise to 1.5 °C.

It is this more ambitious 1.5 °C threshold that guides current EU policy, due to the severe impacts highlighted in the IPCC’s report “Global Warming of 1.5°C”, published in 2018. The report presents empirical evidence that a 2 °C increase could trigger far more devastating consequences across various domains, including biodiversity, climate systems, and societal well-being.

However, pursuing such an ambitious goal requires a clear plan to follow as a roadmap. In recent years, various proposals and legislative packages have been developed to achieve this objective, with the following standing out:

- The European Green Deal, launched by the European Commission in 2019, is a comprehensive strategy that encompasses a range of policies and actions across several sectors. Among its goals are reducing greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels, as well as increasing energy efficiency and the share of renewable energy sources.

In relation to hydrogen, electrolyzers and fuel cells are identified as zero-emission technologies.

Image 1 Objectives of the European Green Deal (Almería, 2020)

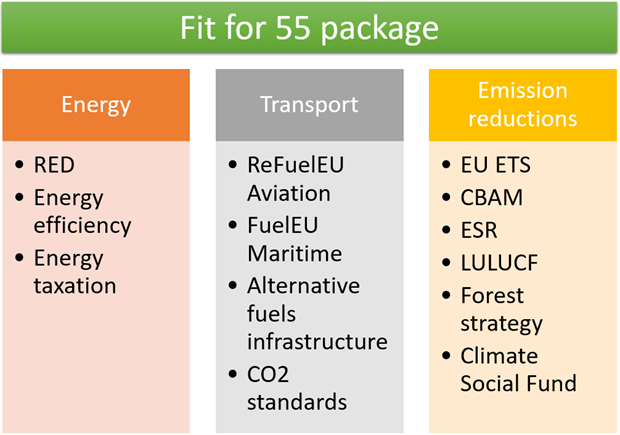

- Fit for 55 is a set of proposals introduced by the European Commission in July 2021, aimed at reducing greenhouse gas emissions by at least 55% by 2030 as part of the European Green Deal. This package includes a broad range of legislative proposals designed to ensure alignment across EU policies. Among these policies is the revision of the EU Emissions Trading System (ETS), with the aim of reducing the number of emission allowances and extending the system to new sectors such as maritime transport. Regarding hydrogen, the Fit for 55 package explicitly expanded the scope of the Renewable Energy Directive (RED II) — which previously applied only to the transport sector — to the entire industrial sector. This expansion includes industries such as cement, metallurgy, and chemicals, and sets minimum targets for the use of Renewable Fuels of Non-Biological Origin (RFNBOs) in transport and industry by 2030. This package of measures (Fit for 55) paves the way for the legislative frameworks that set specific targets, as shown in the following image.

Image 2 Policies derived from the Fit for 55 package (Climatalk, 2021)

- REPowerEU emerged as the European Union’s response to the energy crisis exacerbated by Russia’s invasion of Ukraine in 2022. Its main objective is to reduce the EU’s dependence on Russian fossil fuels and can essentially be summarised as a proposal to further accelerate the goals already outlined by the European Green Deal, Fit for 55, and other initiatives such as the European Hydrogen Strategy. Among its actions is the promotion of renewable hydrogen as a key technology to decarbonise hard-to-electrify industries. Within this context, ambitious targets are set, such as producing 10 Mt of hydrogen within the EU by 2030 and importing another 10 Mt.

In the current year, most of the directives stemming from these plans have been approved by the European Commission, the European Parliament, and the European Council.

Hydrogen is gaining increasing importance in the development of this strategy. The following section presents the plans and policies that have been formulated to support its implementation.

European Plans Related to Hydrogen

As mentioned, the EU has incorporated hydrogen into its strategy almost from the beginning. However, the previous overview is not enough to fully understand the regulatory framework and planning surrounding hydrogen, nor how it has evolved in recent years.

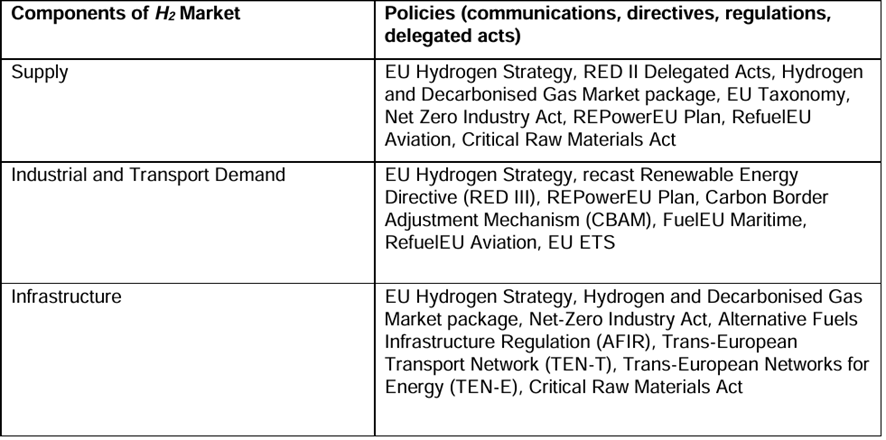

These plans and legislative packages can be categorised based on where their primary impact lies. In this context, we can distinguish between policies that influence supply, demand, and/or infrastructure.

Image 3 Policies Related to Hydrogen (The Oxford Institute for Energy Studies, 2024)

European Hydrogen Strategy, published by the European Commission in July 2020, aims to promote the development and use of renewable hydrogen to support the decarbonisation of the European economy. Among its key targets is the installation of at least 6 gigawatts (GW) of electrolyser capacity in the EU by 2024, increasing to 40 GW and a production of up to 10 million tonnes of renewable hydrogen by 2030. As mentioned previously, this ambition was doubled through the REPowerEU plan, raising the 2030 target to 20 Mt of hydrogen per year—equivalent to 80 GW of electrolysers.

Following the adoption of the European Hydrogen Strategy, the EU recognised the need to address several key aspects, such as the definition of renewable and low-carbon hydrogen and the creation of markets for these molecules. In this context, hydrogen-related provisions have been integrated into the revised Renewable Energy Directive (RED III) through the Delegated Acts. Moreover, extensive work has been done on the Hydrogen and Decarbonised Gas Market package, which was officially approved in mid-2024.

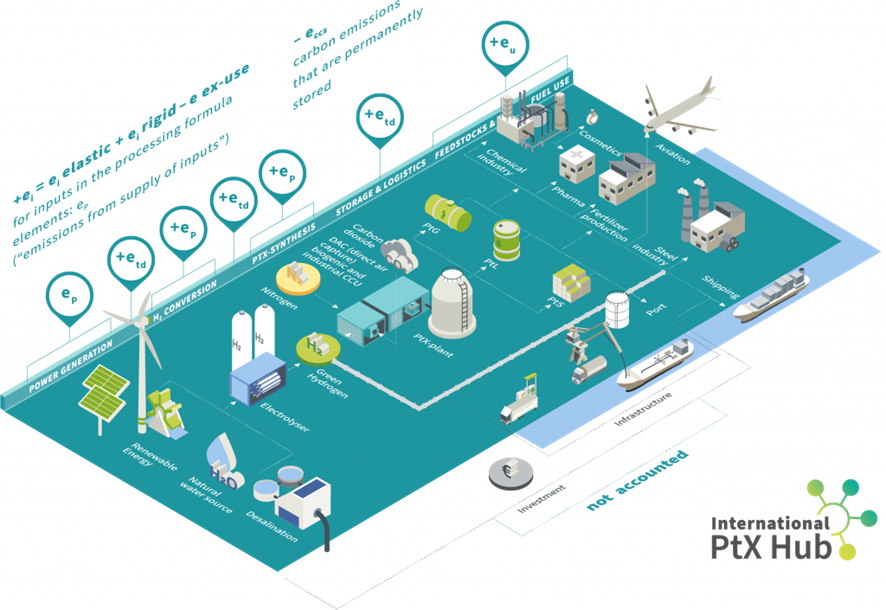

The RED sets targets for hydrogen uptake in industry, as well as the criteria for hydrogen to be considered an RFNBO (Renewable Fuels of Non-Biological Origin). Meanwhile, the Delegated Acts serve as two complementary regulations to the RED, covering:

The first Delegated Act defines the conditions that renewable electricity sources must meet for the electricity used in hydrogen-based fuel production to be considered fully renewable, thereby qualifying those fuels as RFNBOs. In particular, these rules aim to ensure that such fuels are derived from “additional” renewable electricity and meet temporal and geographical correlation criteria.

The second Delegated Act provides a methodology for calculating the greenhouse gas (GHG) emissions across the RFNBO’s life cycle. It also establishes a minimum 70% GHG emissions reduction compared to the fossil fuels being replaced. This second Delegated Act is especially important when considering hydrogen derivatives, as it highlights aspects such as the source of CO₂ for producing methanol or SAF, and the transportation of these molecules. It’s crucial to keep this in mind because, even when producing renewable hydrogen, there is a risk of losing the RFNBO classification if the final product does not meet the 70% emissions reduction threshold. At AtlantHy, we can support you with these requirements.

Image 4 Simplified methodology for calculating GHG emissions of an RFNBO over its life cycle (Scheyl, n.d.)

The Hydrogen and Decarbonised Gas Market package establishes a terminology and certification system for “low-carbon hydrogen,” defining it as hydrogen whose energy content comes from non-renewable sources but achieves at least a 70% reduction in greenhouse gas (GHG) emissions compared to the reference fossil fuel. This package also includes the development of a Delegated Act, which as of November 2024 is still under public consultation and is expected to be officially adopted in early 2025.

Once renewable and low-carbon hydrogen have been defined, it’s important to clarify that this distinction does not necessarily mean one has lower emissions than the other. So, why make the distinction? Because only RFNBO hydrogen is eligible for subsidies, as it is the type contemplated in the EU’s climate objectives.

This means that the Delegated Acts will have a direct impact on hydrogen supply, as producers will need to comply with their requirements to ensure that their hydrogen is classified as an RFNBO and thus be able to reduce production costs.

Now, if these regulations promote hydrogen supply, which regulations will encourage its consumption?

The third revision of the Renewable Energy Directive (RED III) is a key component in accelerating the transition to renewable energy, integrating the climate goals of the European Green Deal, the Fit for 55 package, and REPowerEU.

Many of the targets set by this directive are directly related to the RFNBO hydrogen sector, especially regarding the promotion of its use. This directive sets specific targets for RFNBO use in industry and transport.

In the industrial sector, RED III establishes that at least 42% of the hydrogen used must come from RFNBOs by 2030, increasing to 60% by 2035. However, Member States can reduce this 2030 target by 20% if they meet two conditions:

- First, they must meet their national contribution to the EU-wide goal of reaching 42.5% renewable energy in final energy consumption by 2030.

- Second, the share of hydrogen or derivatives produced from fossil fuels must be 23% or less by 2030 and must not exceed 20% by 2035.

Regarding the transport sector, RED III sets targets for the share of renewable energy in transport, promoting the use of advanced biofuels, renewable electricity, and hydrogen. By 2030, hydrogen and advanced fuels must account for at least 1% of all fuels used in the sector. In the case of RFNBOs, each MJ of fuel can be counted as 2 MJ toward this target.

For the maritime and aviation sectors, a “multiplier” applies that allows each MJ of RFNBO used to be counted as 1.5 MJ in meeting the target.

This has a twofold implication: it encourages the use of this type of fuel, but it means that the actual volumes of RFNBOs required in the transport sector will be lower than the 1% target set.

Therefore, RED III will impact hydrogen demand in both industry and transport, although the readiness to implement the transition to hydrogen varies across sectors, with transport being more advanced. It is important to note that the RED sets obligations on the final fuel consumption in the transport sector, while in the industrial sector it refers to the energy inputs used in the manufacture of “green” products.

In addition to RED III, the ReFuelEU Aviation and FuelEU Maritime regulations (created under Fit for 55) play a crucial role in promoting the use of hydrogen in the transport sector, thus strengthening the European strategy towards more sustainable mobility.

Image 5 Air and maritime transport (FEDESPEDI, 2021)

ReFuelEU Aviation establishes mandates requiring airlines to use an increasing proportion of sustainable aviation fuels (SAF) in their operations within the EU. The aim is to reduce CO2 emissions from the sector by promoting the production and consumption of SAF, which are fuels derived from renewable or sustainable sources with a significantly lower carbon footprint compared to fossil fuels.

ReFuelEU Aviation sets obligations for both production and consumption, which will have implications for stakeholders in both sectors.

Image 6 Aircraft refueling (Carroll, 2023)

FuelEU Maritime promotes the use of sustainable maritime fuels, including advanced biofuels, synthetic fuels, hydrogen, and ammonia, among others. This initiative introduces regulations that set limits on the carbon intensity of fuels used by ships operating between EU ports.

This regulation will progressively tighten to encourage the use of sustainable fuels and penalize non-compliance with emissions standards, ensuring an effective transition toward cleaner maritime transport.

Image 7 Maritime transport (ResourceWise, 2020)

Thus, both RED III and ReFuel Aviation and FuelEU Maritime legally establish mandatory consumption of fuels produced from hydrogen derived from electrolysis, as reflected in the following table:

Table 1 Minimum RFNBO consumption percentages, by sector, relative to total consumption by mode of transport (THE EUROPEAN PARLIAMENT, 2023)

| Sector | Minimum consumption rates | ||||

| 2025 | 2030 | 2035 | 2040 | 2050 | |

| Transport | – | 1 % | – | – | – |

| Aviation (ReFuelEU Aviation) | – | 1,2 % | 5 % | 15 % | 35% |

| Maritime (FuelEU Maritime) | – | 1,2 % | 2 % | – | – |

| Industry | – | 42 % | 60 % | – | – |

In addition to the aforementioned energy regulations, the revision of the EU Emissions Trading System (EU ETS) and the Carbon Border Adjustment Mechanism (CBAM) play a fundamental role in promoting hydrogen by establishing economic incentives that encourage its adoption and use in key industrial sectors.

Under the revised EU ETS Directive, eligibility for the free allocation of EU Emission Allowances (EUAs) has been expanded to include hydrogen production processes from electrolysis.

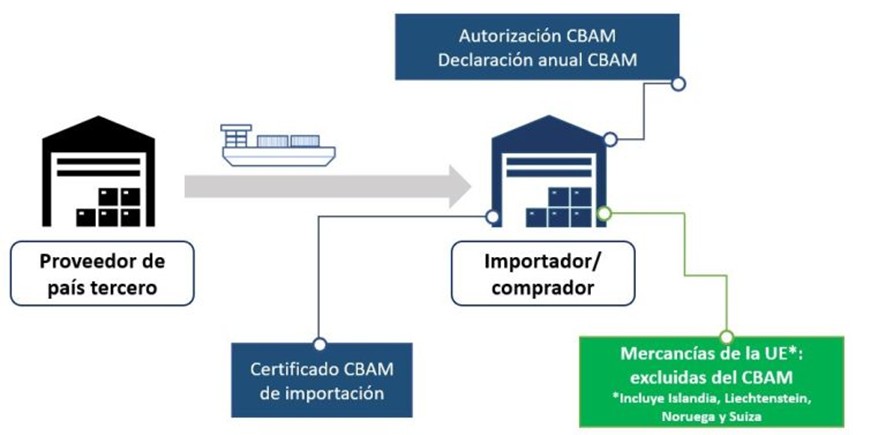

The Carbon Border Adjustment Mechanism (CBAM) is a tool designed to place a price on the carbon emitted during the production of carbon-intensive goods imported from countries that do not apply the same environmental standards as the European Union and are not subject to the EU Emissions Trading System (EU ETS).

Image 8 Potential impact of the CBAM (Solera, 2023)

This mechanism includes hydrogen, although it does not cover the indirect emissions associated with it, such as the electricity used in the electrolysis process for its production. As a result, the CBAM will have an impact on the demand for renewable hydrogen within the EU.

It is important to note that the phasing out of free allocations for the elements included in the CBAM will take place gradually, to be completed by 2034. By removing these free allocations, ammonia and steel producers—who currently do not face real costs for their carbon emissions—will have a strong economic incentive to adopt clean hydrogen in their processes. This is because, by having to pay for emissions, it will become more expensive to continue using fossil fuels, making renewable hydrogen a more competitive and sustainable option for their operations.

Now that we have addressed some of the regulations promoting hydrogen production and consumption, we can ask ourselves: what about infrastructure?

The Alternative Fuels Infrastructure Regulation (AFIR) is part of the Fit for 55 package and aims to promote the development of infrastructure in the EU for alternative fuels in the road, rail, maritime, and aviation transport sectors. This regulation complements ReFuelEU Aviation and FuelEU Maritime.

AFIR sets mandatory deployment targets for hydrogen refuelling infrastructure in road transport. It includes the installation of publicly accessible hydrogen refuelling stations along the Trans-European Transport Network (TEN-T) by 2030.

Image 9 Hydrogen supply (SES Hydrogen, 2023)

These targets will significantly contribute to the development of hydrogen infrastructure through the installation of refuelling stations, thus facilitating its use in transport.

Conclusions

As we have seen, the EU is developing a regulatory framework that promotes hydrogen production, consumption, and infrastructure. Initiatives such as the European Green Deal, the Fit for 55 package, and REPowerEU reflect the EU’s commitment to reducing dependence on fossil fuels and encouraging the use of clean technologies, including renewable hydrogen.

Despite the progress, challenges remain in implementing these policies and the necessary deployment infrastructure. However, the EU’s commitment to fostering a renewable hydrogen market offers significant opportunities on the path toward climate neutrality.

The success of these initiatives will also depend on the development of public financing mechanisms such as the European Hydrogen Bank or the Connecting Europe Facility (CEF), which aim to drive innovation and investment in hydrogen technologies and infrastructure.

Ultimately, Europe is firmly committed to the development of renewable hydrogen. In recent years, it has demonstrated a strong dedication to this sector by drafting supportive regulations for its deployment and establishing various funds to support projects that still face economic challenges.

At AtlantHy, we are committed to contributing to the achievement of these goals, bringing our expertise and capabilities to ensure that companies can develop their projects with the highest chances of success.

Are you in?

Bibliography

Almería, C. d. (2020). El Pacto Verde Europeo. Retrieved from https://www.cde.ual.es/ficha/el-pacto-verde-europeo/

Asociación Española del Hidrógeno. (14th February 2023). Retrieved from https://www.aeh2.org/comision-presenta-acto-delegado-hidrogeno-verde/

Climatalk. (2021). Fit for 55: the Pathway to Salvation? Retrieved from https://climatalk.org/2021/07/24/fit-for-55/

European Comission. (s.f.). Retrieved from https://joint-research-centre.ec.europa.eu/welcome-jec-website/reference-regulatory-framework/renewable-energy-recast-2030-red-ii_en

European Comission. (2020). EU’s hydrogen strategy. Retrieved from https://energy.ec.europa.eu/topics/energy-systems-integration/hydrogen_en#:~:text=The%20European%20Commission%20has%20proposed,10%20million%20tonnes%20by%202030.

European Comission. (2024). Delivering European Green Deal. Retrieved from https://commission.europa.eu/strategy-and-policy/priorities-2019-2024/european-green-deal/delivering-european-green-deal_es

European Comission. (10 of 05 of 2024). Hydrogen and decarbonised gas market. Retrieved from https://energy.ec.europa.eu/topics/markets-and-consumers/hydrogen-and-decarbonised-gas-market_en?prefLang=es

European Comission. (14 of 07 of 2024). REPowerEU. Retrieved from https://commission.europa.eu/strategy-and-policy/priorities-2019-2024/european-green-deal/repowereu-affordable-secure-and-sustainable-energy-europe_en?prefLang=es

European Council. (2022). Retrieved from https://www.consilium.europa.eu/es/policies/green-deal/fit-for-55-the-eu-plan-for-a-green-transition/

European Council. (25 of 07 of 2023). «FuelEU Maritime» initiative: Council adopts new law to decarbonise the maritime sector. Retrieved from https://www.consilium.europa.eu/es/press/press-releases/2023/07/25/fueleu-maritime-initiative-council-adopts-new-law-to-decarbonise-the-maritime-sector/

European Comission. (23 of 06 of 2023). Renewable hydrogen production: new rules formally adopted. Retrieved from https://energy.ec.europa.eu/news/renewable-hydrogen-production-new-rules-formally-adopted-2023-06-20_en

European Commission. (2024). ReFuelEU Aviation. Retrieved from https://transport.ec.europa.eu/transport-modes/air/environment/refueleu-aviation_en

European Union. (12 of 02 of 2023). Retrieved from Commission Delegated Regulation (EU) 2023/1184 of 10 February 2023 supplementing Directive (EU) 2018/2001 of the European Parliament and of the Council by establishing a Union methodology setting out detailed rules for the production of renewable liquid a: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=uriserv%3AOJ.L_.2023.157.01.0011.01.ENG&toc=OJ%3AL%3A2023%3A157%3ATOC

RETEMA. (February 2023). Retrieved from https://www.retema.es/actualidad/nuevas-normas-para-el-hidrogeno-verde-en-europa

Scheyl, J.-H. (s.f.). Delegated Acts on Art. 27 and 28 explained: How they will shape the PtX market ramp up. Retrieved from https://ptx-hub.org/delegated-acts-on-art-27-and-28-explained/

THE EUROPEAN PARLIAMENT. (2023). Renewable Energy Directive (2009/28/EC). Brussels.

The Oxford Institute for Energy Studies. (June 2024). 2024 State of the European Hydrogen Market Report. Retrieved from https://www.oxfordenergy.org/wpcms/wp-content/uploads/2024/06/2024-State-of-the-European-Hydrogen-Market-Report.pdf