At AtlantHy, we’ve taken the plunge. Well, not literally—but we are diving into one of the most exciting ideas of the moment: offshore hydrogen production. This emerging technology has the potential to revolutionise the future of renewable hydrogen. But… what exactly is offshore hydrogen production? What problems could it help solve? And what are its advantages?

We’ll tell you all about it in this AtlantHy Academy article

Currently, hydrogen generation from conventional sources remains the dominant method, with estimated production of around 90 Mt/year, contributing to significant CO₂ emissions. However, the shift towards decarbonisation and the growing competitiveness of renewable hydrogen are beginning to reshape this landscape. By 2050, global demand for renewable hydrogen is expected to account for between 73% and 100% of total hydrogen production, which could translate into approximately 400 Mt/year of H₂, while grey hydrogen is projected to decline significantly to less than 50 Mt/year (McKinsey, 2024).

This shift is primarily driven by the anticipated increase in hydrogen adoption across new applications between 2030 and 2040, supported by both public and private commitments to emission reduction. It is further reinforced by carbon pricing policies, sustainable aviation fuel mandates, and decarbonisation targets in the maritime sector and industry.

But this raises the question: what does this shift towards renewable hydrogen mean for current infrastructure?

Producing 400 Mt/year of clean hydrogen will require the deployment of 4,000 GW of electrolysis capacity, supported by approximately 8,000 GW of renewable generation dedicated solely to this purpose. To put these figures into perspective, current global renewable generation capacity stands at 3,870 GW, meaning that more than double the existing capacity would be needed just to meet clean hydrogen demand. Moreover, these numbers must be viewed within a broader context: according to recent estimates, fully decarbonising the global economy will require reaching a total renewable capacity of 27,000 GW by 2050.

One of the greatest challenges will be the availability of optimal sites for new renewable energy installations, as many of the most efficient areas have already been occupied. This highlights the need to innovate in technologies such as offshore wind. The potential of offshore wind is remarkable. According to estimates, it could generate between 2,600 TWh and 6,000 TWh per year globally, depending on location and technological advancements. This would be enough to meet between 10% and 25% of current global energy consumption—not bad for a technology that’s still taking off (Wind Europe, 2024).

Illustration 1. Offshore wind farm (Wesley Baker, 2020).

But not everything that glitters is gold. Due to its distance from shore and the extreme weather conditions affecting the installations, offshore wind involves high costs both in construction and maintenance. To illustrate this, the CAPEX of an onshore wind farm is around €1.1 million per MW, whereas the CAPEX for an offshore wind installation is significantly higher, reaching approximately €4.1 million per MW by 2025. This highlights the greater technical and logistical challenges associated with offshore deployment—from the complexity of foundation and transport structures to the high operational costs resulting from the limited access for maintenance activities (Catapult, 2024).

So, what are its advantages—and what needs to change to make this technology more attractive?

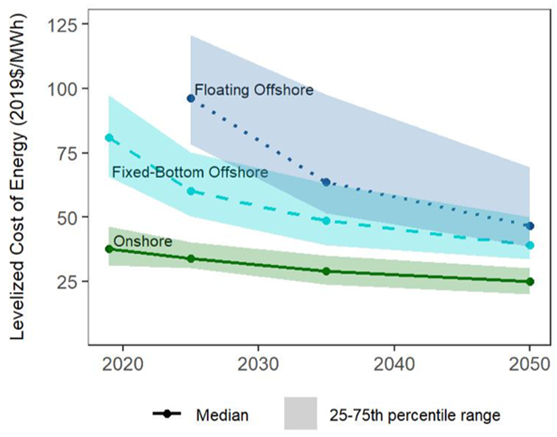

Despite the high costs associated with offshore wind, the following graph illustrates how prices are expected to decline in the future. As previously mentioned, offshore wind technology starts from significantly higher cost levels than onshore due to its technical and logistical challenges. However, there is a clear downward trend in the LCOE (Levelised Cost of Electricity) for both fixed-bottom and floating offshore wind technologies, which will allow offshore wind to become an increasingly competitive option.

Illustration 2. Projected reduction in LCOE costs (Joseph Rand, 2022).

On the other hand, offshore wind turbines generate more energy than those installed on land, primarily due to greater wind availability. Coastal and marine areas typically experience stronger and more consistent winds than inland regions, resulting in a higher electricity generation capacity.

In addition, placing wind turbines at sea avoids land-use conflicts, as they are located in areas that generally do not interfere with other human activities—except, in some cases, fishing.

Let’s recap: so far, we’ve learned that offshore wind has a promising future and that we’ll need to produce large quantities of renewable hydrogen. But you might be wondering… where do these two technologies intersect? And where will it be most interesting to install these hybrid plants?

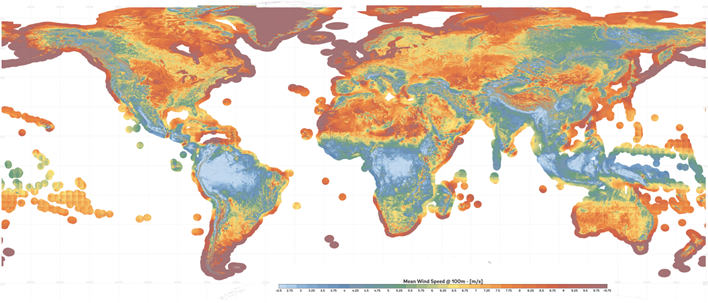

Illustration 3. Global wind speed. (Global Wind Atlas, 2024).

The illustration shows the globally exploitable wind speed in coastal areas up to 60 metres deep, where it is economically viable to install fixed-bottom wind turbines. Although it is currently technically feasible to install floating platforms at depths between 60 and 300 metres, this option is not yet economically competitive. Nevertheless, some pioneering projects already exist, such as Hywind Tampen, located approximately 140 km off the coast of Norway, with turbines installed at depths ranging from 260 to 300 metres (Equinor, 2024).

The darkest shaded areas represent regions with the highest wind resources. Most of these are located in places such as the southern tip of South America, the islands of New Zealand, Alaska, and even Greenland—locations with very low population density and limited, if any, electricity transmission infrastructure. This is where the hybridisation of offshore wind farms with hydrogen production starts to make sense. This combination allows the energy generated to be stored and later transported to urban and industrial centres around the world.

In addition, generating hydrogen using seawater in these offshore areas could help alleviate global water stress by using seawater for electrolysis. However, as explained in our article on water treatment, the water would first need to be treated to remove impurities and microorganisms before it can be used in the process.

Illustration 4. Prototype of the Sealhyfe offshore hydrogen production platform (Lhyfe, 2023).

Let’s talk about the economics—will offshore hydrogen production ever be profitable?

From a cost perspective, the CAPEX—or initial investment—for an offshore wind farm, as noted at the beginning of this article, is currently around €4.1 million per MW installed. By 2040, this cost is expected to drop to €1.7 million, with an even greater impact on the price of the electricity generated.This reduction will be driven in part by improved understanding of the technology, which will, for example, help to lower financing costs.

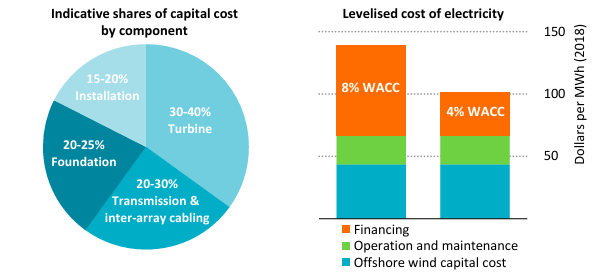

To illustrate this, take a look at the graph on the right—it shows how the LCOE decreases significantly when a lower WACC is applied. With a WACC of 8%, the LCOE exceeds $100/MWh and approaches $150/MWh, but when reduced to 4%, it drops below $100/MWh—representing a 30% reduction. What does this mean? That with cheaper financing, offshore electricity becomes significantly more competitive.

Illustration 5. Indicative breakdown of capital costs by component and levelised cost of electricity for offshore wind projects completed in 2018 (International Energy Agency, 2019).

However, one important factor to consider is the transmission of electricity to shore. This is a mature market, with no significant cost reductions expected. In fact, while transmission currently accounts for around 20–30% of total CAPEX, it is anticipated that by 2040 this share could rise to 50%, due to the rapid decline in the cost of other components, while transmission costs are likely to remain relatively stable given the maturity of the technology.

This is where hydrogen presents another advantage, as it does not require electricity to be transmitted to shore in order to be produced. Electrolysers can be installed directly on each wind turbine structure, following a decentralised hybrid plant design, or alternatively on a platform connected to several turbines within the offshore wind farm—adopting a more centralised approach. With capacity factors of 60% and highly competitive electricity costs, it would not be unrealistic to envision offshore hydrogen being produced at €2–3/kgH₂ once these technologies reach maturity.

Moreover, decommissioned offshore oil and gas platforms could potentially be repurposed to host electrolysers, water treatment equipment, and storage or transport systems. This would represent a significant saving in installation costs.

Conclusion

In conclusion, offshore wind and renewable hydrogen are two technologies destined to converge. While infrastructure costs remain high at present, projections point to a promising future as both technologies continue to improve and become more efficient. It is highly likely that the synergy between offshore wind and hydrogen will become one of the key pillars of a renewable energy future.

Lastly, don’t forget that at AtlantHy we work every day on projects related to hydrogen.

The synergy between offshore wind and hydrogen represents a key opportunity to decarbonise the global economy, and we have the expertise needed to support and develop projects in this field.

That’s why, together with Bluenewables, we’ve created a joint venture: HyBlue, through which we provide consultancy and engineering services for offshore hydrogen production.

You can learn more about this in Episode 80 of El Podcast del Hidrógeno.

If you found this article interesting, stay tuned—we’ll continue exploring infrastructure development and new technologies applied to offshore hydrogen production.

Don’t hesitate to get in touch—let’s take your project to the next level!

References

Catapult. (2024). Wind farm costs.

Equinor. (2024). Hywind Tampen. Retrieved from https://www.equinor.com/energy/hywind-tampen

G. Rubio-Domingo, P. L. (2021). The future investment costs of offshore wind: An estimation based on auction results.

Global Wind Atlas. (2024). Retrieved from https://globalwindatlas.info/es/download/high-resolution-maps/World

International Energy Agency. (2019). Offshore Wind Outlook.

IRENA. (2024). FLOATING OFFSHORE WIND OUTLOOK.

Joseph Rand, J. S. (2022). Expert perspectives on the wind plant of the future. Wind Energy.

Lhyfe. (2023). Lhyfe announces that Sealhyfe, the world’s first offshore hydrogen production pilot, produces its first kilos of green hydrogen in the Atlantic Ocean! Retrieved from https://www.lhyfe.com/press/lhyfe-announces-that-sealhyfe-the-worlds-first-offshore-hydrogen-production-pilot-produces-its-first-kilos-of-green-hydrogen-in-the-atlantic-ocean/

Mckinsey. (2024). Global Energy Perspective 2023: Hydrogen outlook.

Rebecca Fuchs, A. C. (2024). The Cost of Offshore Wind Energy in the United States From 2025 to 2050.

Wesley Baker. (2020). Wesley Baker. Retrieved from Wesley Baker

Wind Europe. (2024). Wind energy in Europe: 2023 Statistics and the outlook for 2024-2030.